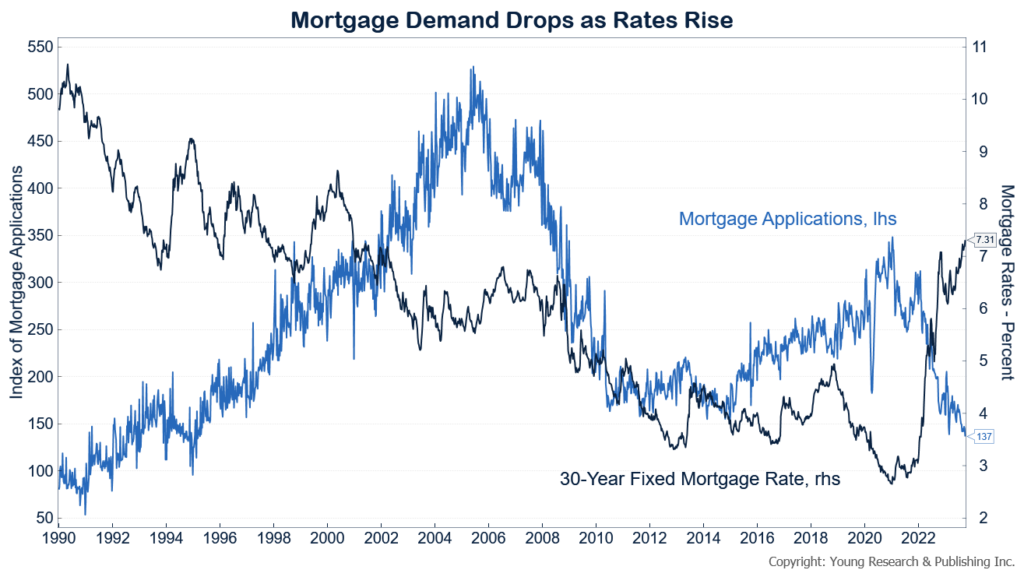

As interest rates have climbed, demand for mortgages has declined to the lowest levels seen since 1996. Diana Olick reports for CNBC:

Mortgage rates just continue to climb higher, taking a particularly big leap last week. As a result, total mortgage demand fell 6% compared with the previous week, according to the Mortgage Bankers Association’s seasonally adjusted index.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) increased to 7.53% from 7.41%, with points rising to 0.80 from 0.71 (including the origination fee) for loans with a 20% down payment. That rate was 6.75% the same week one year ago.

“Mortgage rates continued to move higher last week as markets digested the recent upswing in Treasury yields,” said Joel Kan, MBA’s vice president and deputy chief economist. “As a result, mortgage applications ground to a halt, dropping to the lowest level since 1996.”

Applications to refinance a home loan dropped 7% for the week and were 11% lower than the same week one year ago. Refinances now make up less than one-third of all mortgage applications. Just two years ago, when rates were setting multiple record lows, refinance demand made up roughly three-quarters of all mortgage applications.

Applications for a mortgage to purchase a home fell 6% for the week and were 22% lower than the same week one year ago.

“The purchase market slowed to the lowest level of activity since 1995, as the rapid rise in rates pushed an increasing number of potential homebuyers out of the market,” said Kan, who also noted that adjustable-rate mortgage (ARM) applications increased. The ARMs made up 8% of purchase applications, up from 6.7% about a month ago, when interest rates were slightly lower. ARM’s offer lower rates but are fixed for a shorter term, usually five or 10 years.

Read more here.

If you’re willing to fight for Main Street America, click here to sign up for the Richardcyoung.com free weekly email.