There’s a mountain of debt coming to markets. The editors of The New York Sun wonder how the world will survive. They write:

One can imagine how Noah felt when he was told to build his ark. Today, a “deluge of debt,” as the Financial Times puts it, threatens the world, with “unmoored” borrowing sparking market fears. Bloomberg sounds the alarm that in the weeks ahead, developed nations “will start flooding the market with bonds at a clip rarely seen before.” Government spending is eyed as a problem, but the root cause is fiat money that has loosed the debt floodgates.

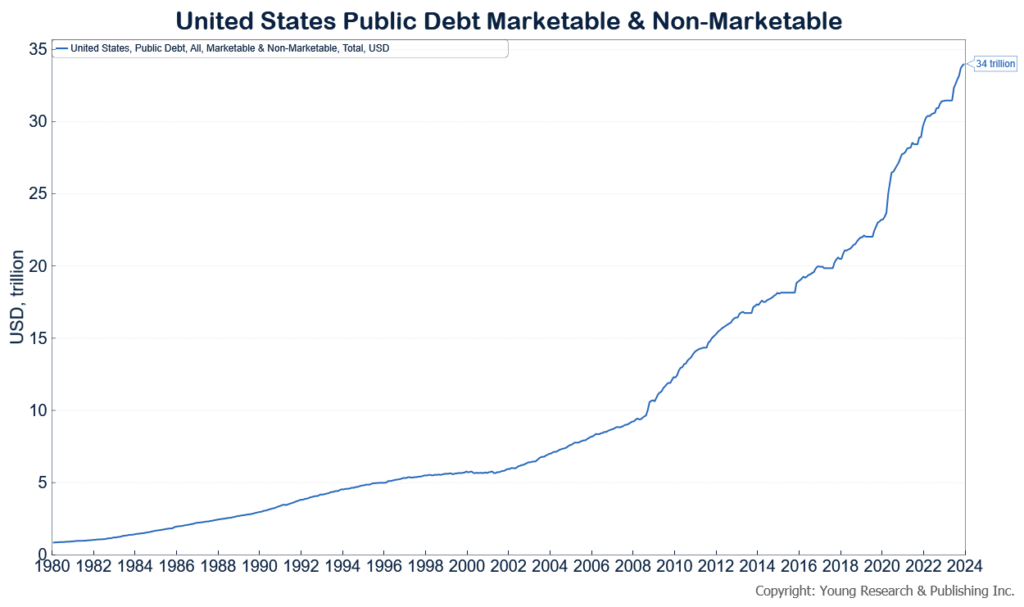

America will issue “about $4 trillion of bonds this year,” the FT says, up from $3 trillion last year. In the next several weeks alone, Bloomberg warns, America, Britain, the Eurozone, and Japan will “sell a net $2.1 trillion of new bonds to finance their 2024 spending plans.” It reflects a tsunami of government spending. Deficits, an analyst tells the FT, are “out of control and the real story is that there’s no mechanism for bringing them under control.”

No one will disagree that deficits are too high. In America, the deficit has been running at six percent of gross domestic product, Bloomberg observes. The public debt burden in the developed world, the International Monetary Fund reports, has “soared to more than 112 percent of GDP from about 75 percent two decades ago.” The fear is that all this debt is going to start raising borrowing costs and crimping economic growth worldwide.

“We are truly in an unmoored environment for government debt compared with previous centuries,” the head of global bonds at PGIM Fixed Income, Robert Tipp, tells the FT. That offers a hint as to the “mechanism” to dam up this flood of red ink, though. After all, what distinguishes the modern economy from its historic antecedent? It’s the turning away from the classical basis of monetary value, gold and silver, in favor of fiat currencies.

When America’s national debt soared past $31 trillion — it has since topped $34 trillion — these columns lamented how this Everest of debt was a symptom of the fiat money era. Before 1971, when Nixon severed the dollar’s last link to gold, an accumulation of debt on this scale would have been impossible. This is because a metallic standard imposes a fiscal discipline on governments, and central banks, by requiring scrip to be convertible into specie.

Read more here.

If you’re willing to fight for Main Street America, click here to sign up for the Richardcyoung.com free weekly email.