Look, it’s been a good run for stocks. It’s reflected in your net worth—if you can keep it. Because there comes a time when you need to ask: Do I NEED this STRESS? One of the hardest decisions for stock investors is not when to buy, but when to SELL. Here’s a back of a napkin stress test for you and your spouse: How will you feel if your stocks fall by 50%? Now sell stocks to the point where a 50% loss in stocks would be SURVIVABLE. That’s what my focus is for you: SURVIVABILITY. Because Your Survival Guy knows what you sound like when disasters like that happen.

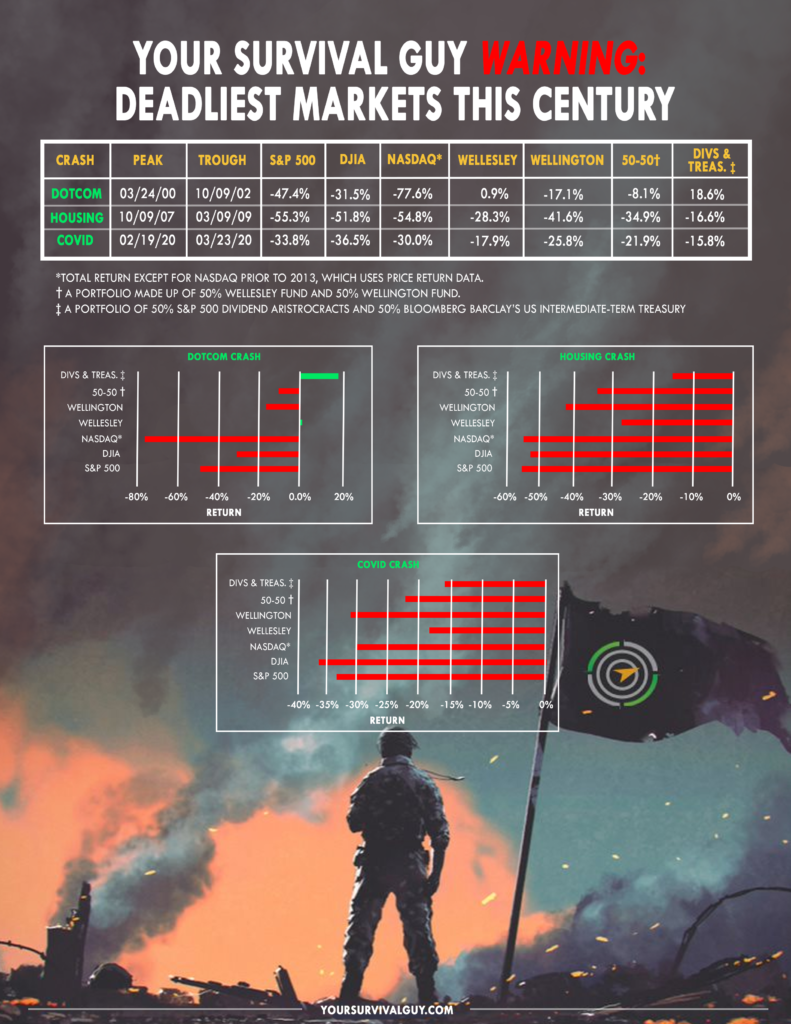

But lo and behold, after the dust settles, a prospective investor will tell me, “I got hurt bad and I can’t afford to lose like that anymore.” Don’t learn what your breaking point is in the MIDDLE of the next disaster. That’s too late. When I show you how ugly markets can be in my Survival Guy Deadliest Markets This Century, you don’t say, wow, Survival Guy great illustration, that really shows me how bad markets can be, thank you Survival Guy.

No, you say “Well, you know, Survival Guy, there’s been a lot of good years this century too.” Right. Uh huh. I must have missed that. Thanks for the info, Mr. Obvious. Because Mr. Obvious either tucked that previous stock crash heartache so deep into his psyche it’s gone, and no lesson learned, or he was a younger man back then. This time it absolutely is different. This IS a Younger Man’s market.

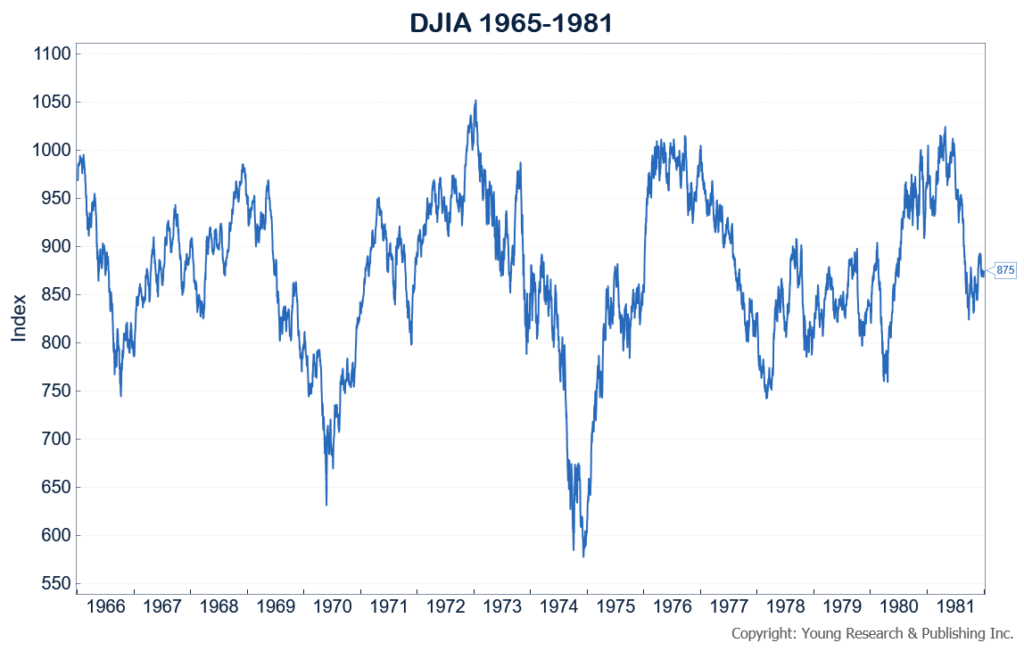

“Hold the line,” they say. “Stocks always go up over time Survival Guy.” Time is relevant. Relevant to your investing lifetime. Because when you look at how much time it took for the Dow to come back during the great inflation of 1965-1981, and more recently the NASDAQ from 2000-2015, you get a sense of how long you might have to “hold the line.” Fifteen years and your retirement may be mostly over before you get back your money.

And yet, Mr. Retiree will never accept 1% on his money. Mr. Retiree reaches for yield in places like real estate loan portfolios paying 10% (for now at least) to support the LIFESTYLE. I can write until I’m blue in the face about emails I receive about deals too good to be true asking that I share them with my readers. Give me a break. I’m Your Survival Guy and I see serious CARNAGE ahead.

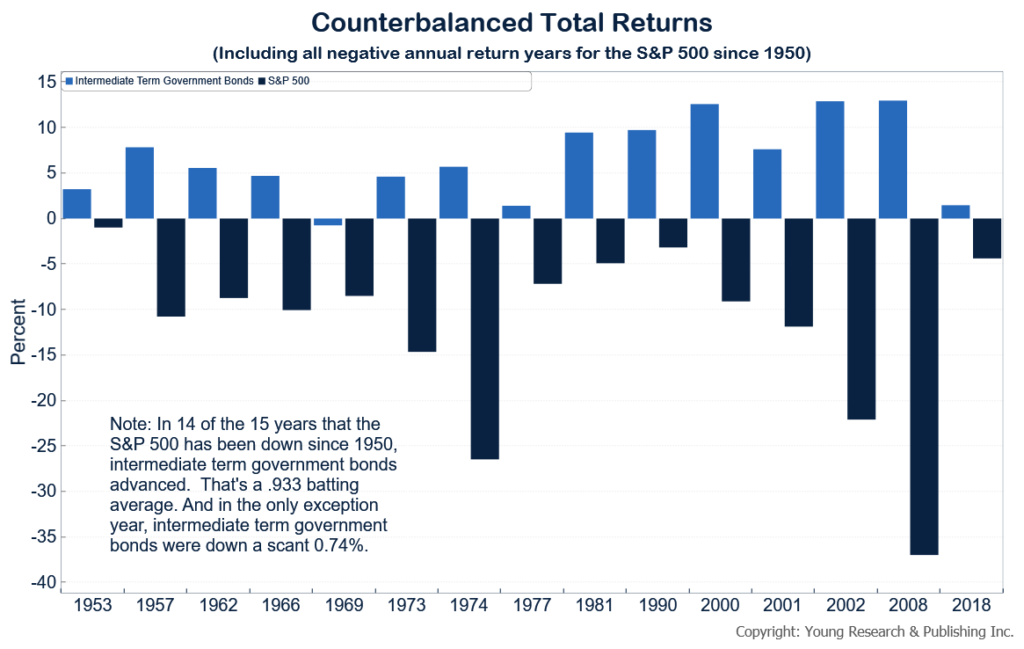

Action Line: It’s no excuse to say you don’t understand bonds. I’m here to help. It’s up to you to make it happen.

P.S. Look at this. And yes, it’s up to date, because 2018 was the last year stocks were down. You invest in bonds so you can invest in stocks. It’s that simple. And yet it’s so hard to do.

Originally posted on Your Survival Guy.

If you’re willing to fight for Main Street America, click here to sign up for the Richardcyoung.com free weekly email.