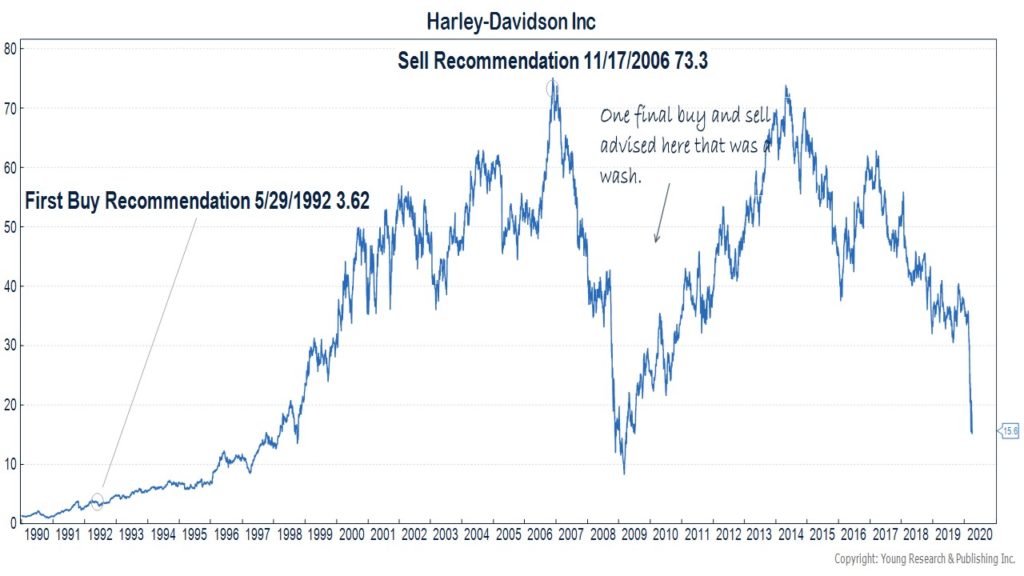

Harley was Young Research’s “Stock of the Decade” in the 1990s. The shares were first recommended as a buy in May of 1992 at a price of $3.62. During the 2000s, we advised a series of buys and sells chronicled in the chart below.

The chart runs through 2007 and there was only one additional buy and sell recommendation that was essentially a wash. On the sale we explained:

“The dynamics of Harley’s business have changed. HOG has transitioned from a growth company to a cyclical company reliant on a consumer that may be jobless, over-indebted, and unable to obtain financing. Demand for Harley-Davidson motorcycles is depressed and may stay that way for a while. For the year, Harley expects to produce 222,000 to 227,000 bikes. The last time so few bikes were produced was 2000, when earnings were slightly over $1.00 per share. At $28 per share, Harley was trading at 28X earnings. Long-term, a fair multiple for the stock is 15X.”

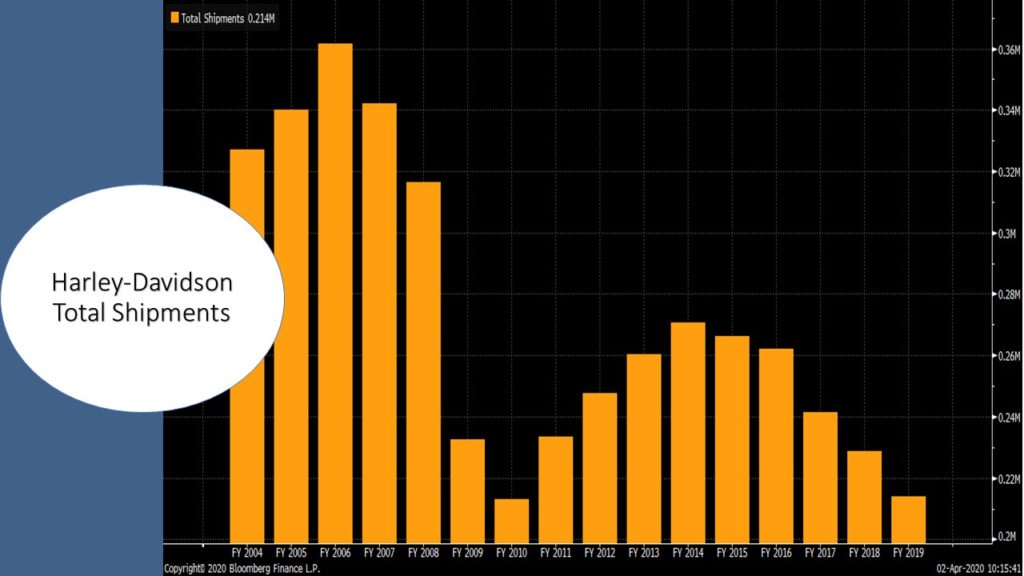

The chart below shows the annual shipments of Harley-Davidson Motorcycles from 2004-2019. Even after hitting a cyclical low in 2010, Harley shipments never recovered to their prior peak.

What was true more than a decade ago remains true today. Harley is not a growth business as the last five years of declining shipments in a booming economy prove. Harley should be managed more like a niche player with a modest, but loyal following.

With the CEO stepping down in February and the Chief Operating Officer also leaving the firm, Harley looks ripe for an acquisition. We wouldn’t be surprised if the board was shopping the shares as we speak.

The most logical buyer (though there may be others) would seem to be Polaris. Polaris is already in the motorcycle manufacturing business with Indian Motorcycles and as a bonus, they still have a management team.