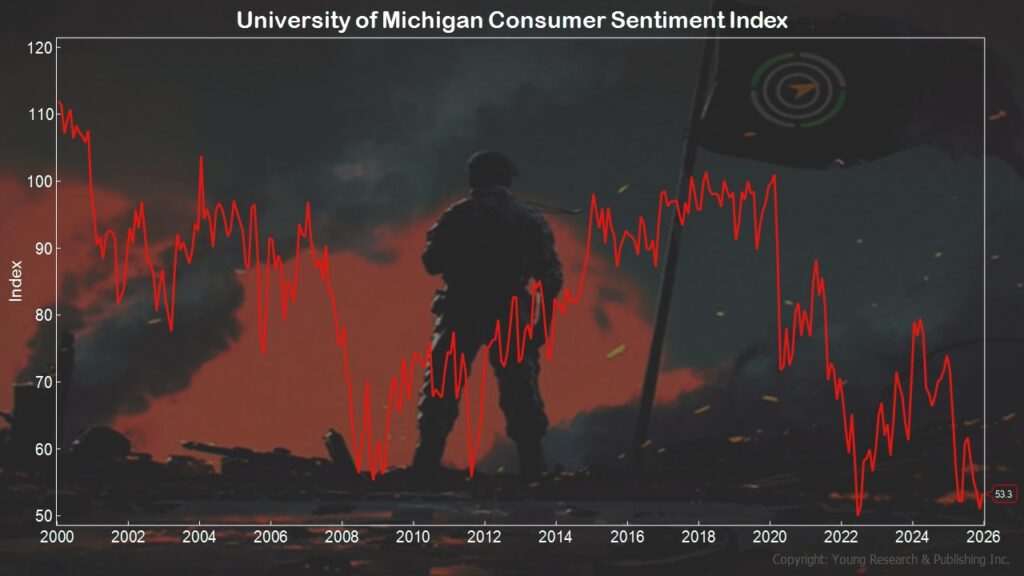

Your Survival Guy’s RAGE Gauge is in, and it’s not pretty. What did you expect me to say? As you know from my series here, customers are not happy. According to the National Customer Rage Survey (love the name), 77% of customers reported a product or service problem in the past year—a new high. It was at 50% back in 2013.

Is it time to flee to greener pastures? You can read about my 2025 Super States here and draw your own conclusions.

But here’s the deal. We’re living in two different worlds. My focus has always been on you, my successful Americans who have saved ‘til it hurt and worked for a lifetime, who are now the haves if not yet the have yachts. You know what it’s like to have money, and that’s the point of our visits.

OK, today we have a mixed bag of unhappy consumers mixed with positive GDP projections. Inflation is an issue, and yet retail sales are looking good. Stocks, until the most recent pullback, were flying high like every day is a CAVU day (Ceiling and Visibility Unlimited). But clearly, that is not the case, as investors are realizing the hard way (as they always do) that their risk tolerance is less than they thought it was.

That’s why, when it comes to risk tolerance and asset allocation, Your Survival Guy always begins my conversations with you about your fixed income component, not my predictions about the stock market.

When you look at how gold has become untethered, it suggests that “Houston, we have an inflation and spending problem in Washington,” regardless of which party is in office.

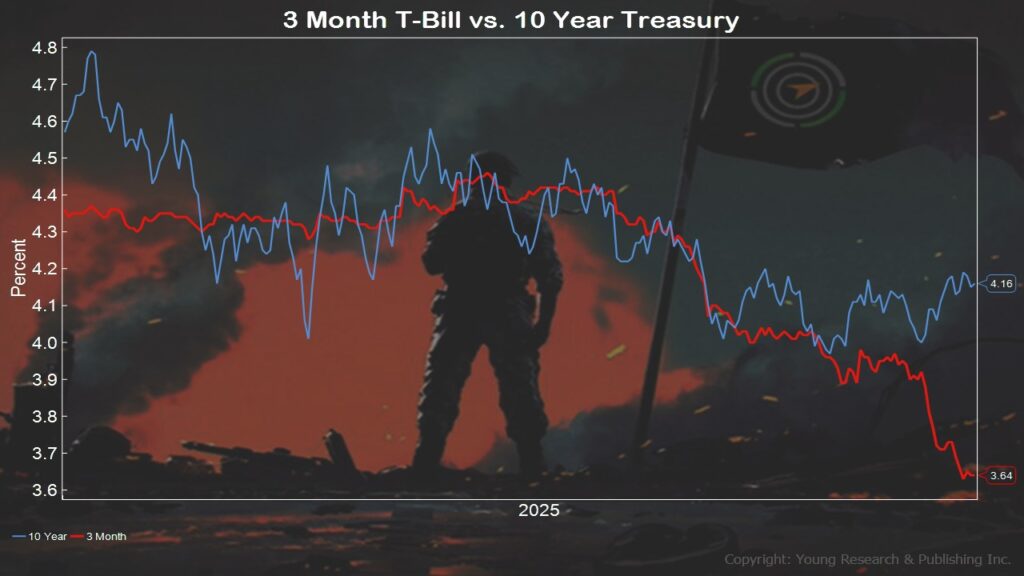

The Fed is back to its old tricks, paying scant attention to M2 growth, focusing on unemployment and cutting rates, and a mini return to quantitative easing, both of which are a tax on retirees stuck dealing with their lazy cash sitting on their couch. The bond market is saying “not so fast,” as shown with the separation between T-bills and the 10-year.

Action Line: Your job is to get your lazy cash off the couch to live a productive life. To develop an investment plan so you can sleep well at night. To have the answer when your spouse asks, “How’s our money, honey?” And to figure out how to harness the power of time, which is the straw that stirs the drink called compound interest. If you need an intervention, I’m here. Email me at ejsmith@yoursurvivalguy.com.

Originally posted on Your Survival Guy.