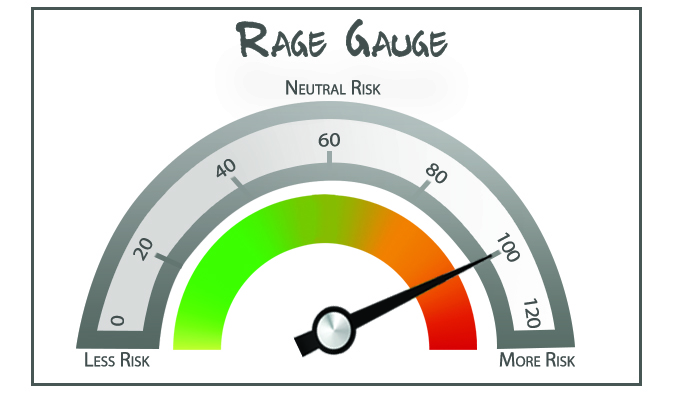

You don’t want to get caught in the fog without some know-how. That’s how Your Survival Guy feels about this market. You want to be prepared. Because we just don’t know when disasters will strike. Which brings me to this month’s RAGE Gauge. It’s not pretty out there. What did you expect from Your Survival Guy?

Let’s start with gold. Even after the recent run-up, we’re not at an all-time high in real terms.

What’s devastating is how weak the dollar has become relative to gold. Before the link between the dollar and gold was broken, a dollar was worth 1/35 of an ounce of gold. Today, it’s worth 1/2371 of an ounce of gold. That’s a decline of 98.5% in the value of the dollar versus gold. The manipulated CPI numbers show a still startling decline of the dollar’s value by 87.3% since 1971, the year Nixon ended gold convertibility. But maybe gold tells the real story.

Fed Chairman Powell tells us a weakening job market and inflation keep him up at night. But clearly, he sees the mountain of debt and the interest costs to finance it. You can bet he’s thinking about how to bring those costs down as well. As our debt builds, you can add that as the third leg of the stool that will drive Fed interest rate decisions.

If you don’t like risk, now is the time to focus on your fixed income component. Risk is a word most investors realize they are intolerant to, like a food allergy, after the fact. Know what you’re putting into your portfolio beforehand, not after.

As I mentioned above, Your Survival Guy and Gal were caught up in some fog on our boat. You can read about it here. It’s a real-life lesson about understanding risk and your tolerance for it.

With the Paris Olympics set to begin later this month, luxury hotel bookings are way off. As I wrote to you about our trip in May, the traffic is and will be a nightmare, and not to mention many local service workers will be on vacation to avoid the hassle. Who’s going to serve the escargot?

Yes, the U.S. dollar is strong relative to other fiat currencies. But it’s incredibly expensive to travel and eat abroad. I see this as a bullish signal for packaged trips, especially river cruises, where travelers know what they’re paying for before they leave home. Traveling can be nerve-wracking. The last thing folks want is a surprise bill and then trying to “get through” the rest of the trip and back home safely.

So far so good for the stock market. Hey, it’s an election year, what did you expect? But how good will it be when half the populace is unhappy with the results? Prepare accordingly. You know what a mess blue blob cities are and the expanding no-go zones. Gun sales are steady. Get yours and your training now. With emphasis on your training because it’s a perishable skill. It’s not like riding a bike. You need to practice, practice, practice. Here’s my top ten tactical shotguns.

Action Line: Your relationship with your advisor should be a special one. You deserve to be treated like royalty, not like a loyalty card holder where nobody knows your name. My SPECIAL REPORT on Vanguard shows how the tide is changing. Let’s talk about you, not your SSN. You can reach me here. But only if you’re serious.

Originally posted on Your Survival Guy.

If you’re willing to fight for Main Street America, click here to sign up for the Richardcyoung.com free weekly email.