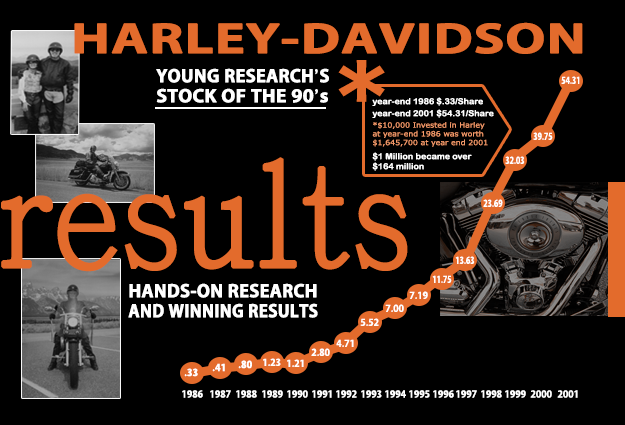

Debbie and I have put over 100,000 miles on our Harleys riding across the United States and Canada. My riding days are behind me, but as a devotee, I keep an eye on Harley’s business, as I have for years. If you’re one of my long-time readers, you know Harley was Young Research’s stock of the decade in the 1990s.

In June 1998, I and millions of Harley-Davidson fans celebrated the company’s 95tht anniversary. I wrote then:

For about $18,000, you can be astride a classic American cruiser, the Harley-Davidson Road King—if you can get one. This summer Debbie and I will ride our Harleys from Key West to Nova Scotia before our trip to Glacier National Park and back to Sturgis, South Dakota, for the world’s biggest annual gathering of the Harley faithful. At Milwaukee’s Summerfest grounds on June 13, Harley-Davidson (NYSE: HDI) will have its 95th anniversary celebration reunion. Once again, there is a lot to celebrate. Over the last year, Harley’s stock has nearly doubled. Over the last five years, as my most recommended stock, Harley-Davidson has provided an average annual total return of nearly 30% per year.

As both an investor and rider, I have a long history with Harley-Davidson. Harley’s core market peaked years ago, and so did bike shipments, but management continued to chase the prospect of growth.

That strategy failed.

Harley is now scaling back production and focusing on its bestselling models.

The WSJ reports:

On an earnings call last month, Mr. Zeitz said expanding the motorcycle lineup and chasing new markets diverted attention from Harley’s more profitable models and made factories too complex. He said the production revamp is warranted by deteriorating demand for motorcycles. New models that would have made their debut this summer will roll out early next year instead, he said, on a new schedule of releases before the peak spring buying season begins.

By having fewer motorcycles in the market, Harley said it is trying to appeal to customers of premium-priced brands with limited availability. That approach is common among makers of sports cars and some luxury products that keep manufacturing volumes well below demand for them.

“Our strategy to limit motorcycle product in the showroom is purposefully designed to drive exclusivity,” Ms. Truett said in her memo.

Harley is reopening its plants in Wisconsin and Pennsylvania this week and said it would accelerate production in phases. The motorcycles that Harley will start making again this month will be limited to bestselling models in a limited palette of colors and without customizable features for the remainder of the year, Ms. Truett wrote.

The future for Harley is as a niche player with a shrinking but dedicated consumer base. That strategy may work in the public markets, but would be much more suited as a subsidiary of another firm. Polaris seems like a natural fit.

Originally posted on Young’s World Money Forecast.

If you’re willing to fight for Main Street America, click here to sign up for my free weekly email.