UPDATE 4.5.23: Gold is once again nearing all-time highs. Jim Wyckoff of Kitco News reports:

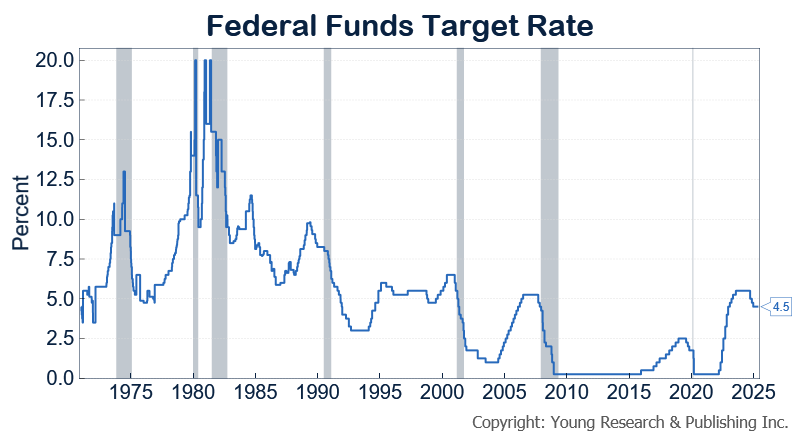

A standout feature in the marketplace this week is gold prices pushing above $2,000.00 an ounce and closing in on the record high of $2,078.80, scored in March of 2022. A weakening U.S. dollar index and a surge in crude oil prices this week have helped to rally the yellow metal. Safe-haven demand amid the banking turmoil in the U.S. and Europe are also boosting gold and silver. JP Morgan chief Jamie Dimon said in a report issued Tuesday that the banking crisis is not over.

UPDATE: 1.25.23: Gold prices are reaching for new highs, and something interesting is going on in the market for gold. China has been buying up lots of it, and it’s not alone. Other countries are boosting their own gold exposures in a world that is increasingly volatile. Anna Golubova reports for Kitco:

China imported more gold from Switzerland last year and stepped up gold purchases from Russia, according to the latest import data releases.

Swiss exports of gold to China were at four-year highs in 2022, with China taking in 524 tonnes of gold worth around $33 billion. This is a massive increase from 354 tonnes reported in 2021 and the most since 2018, according to Swiss customs data.

China is the world’s number one gold consumer, followed by India, with a focus on retail investment and jewelry demand.

In a separate dataset published by Russia’s customs agency over the weekend, China also increased its purchases of Russian gold. China bought 6.6 tons of gold from Russia in 2022, which is an increase of 67% from 2021, local Russian media reported.

China’s central bank also stepped up gold purchases at the end of last year, buying 30 tons of gold in December, which followed its November purchase of 32 tons of gold — the People’s Bank of China’s first officially recorded purchase since September 2019. China’s gold reserves now total 2,010 tons.

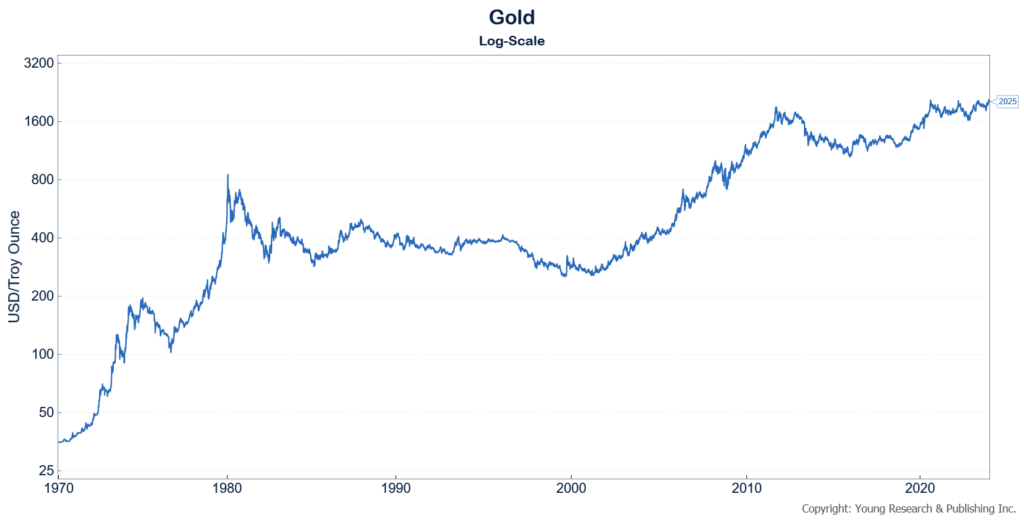

UPDATE 1.5.23: Gold has been gaining on the dollar’s weakness relative to other currencies as the world catches up to America’s interest rate increases. This morning, some better-than-expected private payroll numbers have squelched a gold rally by forcing traders to consider that the Fed may continue to pursue more hawkish policy, potentially boosting the dollar again. In my chart below, you can see gold’s decades of strength as the dollar has waned in value thanks to Fed and federal government inflationary policies.

Originally posted on July 27, 2020.

Part I

I was there from the start. In early August 1971, I had just joined internationally focused research and trading firm Model Roland & Co.

On 15 August 1971, President Nixon shocked the world by announcing that the U. S. would no longer officially trade dollars for gold. At that time, gold’s fixed price was $35/oz.

By 1980, gold would hit an astronomical $800/oz.

OK then, back to Model and the firm’s wonderful head partner Leo Model. From my first day onboard at Model, I started covering a bevy of major Boston institutional accounts. I was 30 years old, and I would become friends with analysts, portfolio managers and traders at Wellington Management, Fidelity Investments, First National Bank of Boston, State Street Bank, State Street Research, Endowment Management, Studley Shupert, and Keystone Management through my entire investment career on Federal Street in Boston.

I immediately realized that international trading (including gold shares and arbitrage), as well as monetary strategy and world currencies, was going to be my focus from August 1971 onward.

Five decades later, these subjects remain today my daily focus. I have been a buyer of gold, silver, and Swiss francs for decades, and I have never sold a single one of my positions.

By 1972 I was off to London on a mission for Leo Model. My job was to produce a strategy report for Model, Roland & Co on the international gold shares market. It took eight days in London to meet all the insiders with whom Mr. Model had arranged visits. Except for a single, most unpleasant glitch, (understatement) all went well.

I went on to submit a 25-page strategy report to Mr. Model. Shortly thereafter I was informed that Mr. Model had sent my report along to the firm’s chief monetary guru, one Edward M. Bernstein, one of the architects of the Bretton Woods monetary agreement.

Remember, I was 31 years old, and quite terrified to hear that EMB had been brought into the loop.

On 7 August 1972, I received the surprise of my young life: EMB wrote back on his corporate letterhead:

I think the collection of papers on gold is excellent. It seems objective and pointed. I have no suggestions. Put me on the list to get what you put out on gold.

Sincerely,

Edward M. Bernstein

Although I did not know it at the time, a year later, I would no longer be at Model, Roland.

Check back in with richardcyoung.com for my introduction Part II and the kickoff of our industry-leading precious metals, currencies, monetary madness, fed maleficence and dollar destruction weekly update.

Warm regards,

Dick

Originally posted on Young’s World Money Forecast.

If you’re willing to fight for Main Street America, click here to sign up for my free weekly email.