When Your Survival Guy was a kid, my dad and I rented a canoe and explored Fort Wilderness in Walt Disney World by water. That’s where I saw my first armadillo. They were rooting in the dirt a little too close to shore for my comfort level. Being from New England, I wasn’t quite sure what I was seeing.

Were they friendly? Aggressive? I didn’t know. But I knew I wasn’t interested in finding out. Not having the best control of our vessel, our limited paddling skills kept getting us stuck on shore. I wasn’t freaking out. I was in the front, and we kept getting too close to these little creatures. Panicked, I repeated frantically, “Dad, back up! We need to get off this beach.”

“It’s fine,” he said, “They’re harmless, they won’t bother us.”

That didn’t help my condition.

When I think about that morning, I probably looked like a cartoon character running on air, tipping the canoe every which way, trying to get away.

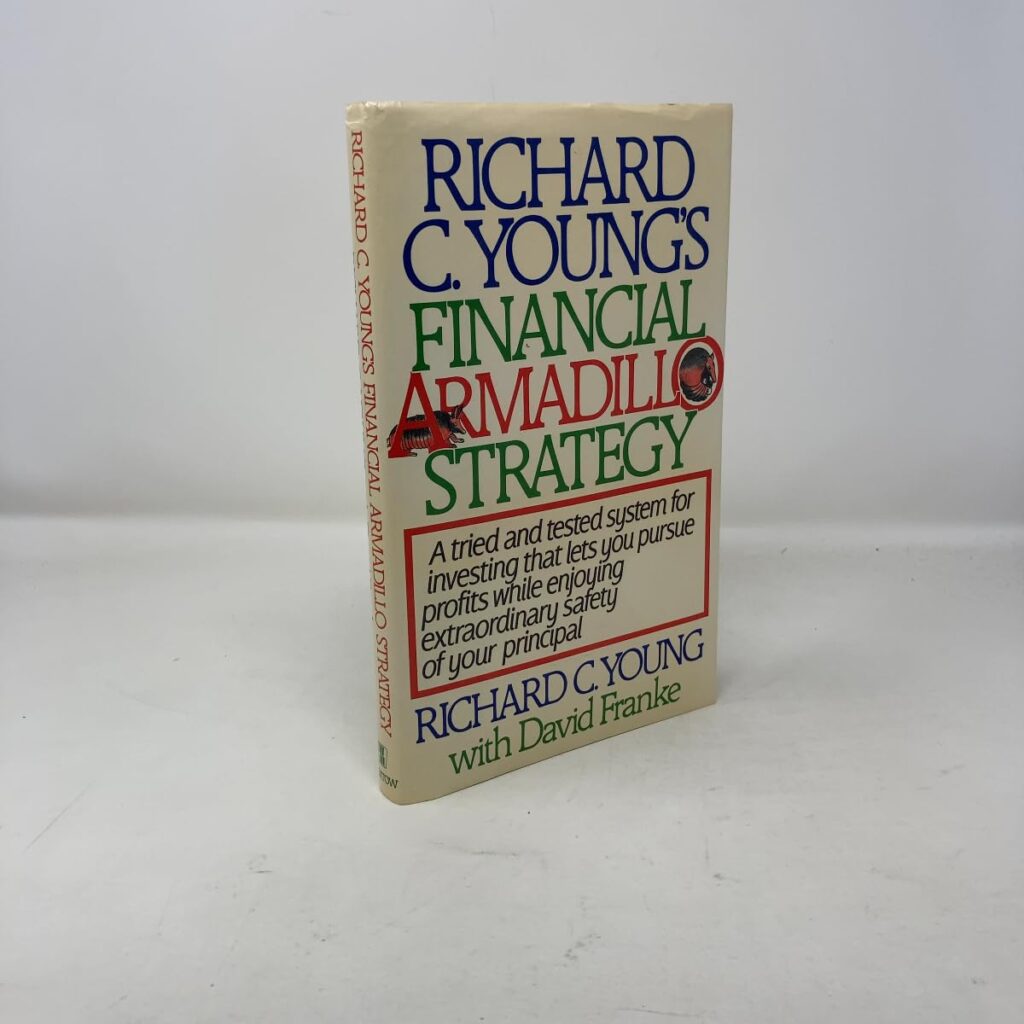

Several years later, in my early twenties, you can imagine my surprise visiting Becky’s house for the first time and seeing a wood carving of an armadillo in their living room. “That was a gift,” she told me, “His book was about being a financial armadillo.”

You can’t make this stuff up.

I have a copy of the book on my desk staring at me as I write to you. Here’s five rules you need to know to be a financial armadillo and become a compounding machine, written by Dick Young himself:

- Take a pledge of allegiance each day to your most trusted investor ally, compound interest. Learning how to better harness the awesome power of compound interest assures you of long-term success. It is interest on interest that allows you to invest like the world’s most successful capitalist, Warren Buffett.

- Commit to memory the first two rules of investing. Rule #1: Do no lose your capital. Rule #2: Do not forget Rule #1.

- Ruthlessly slash, hack and chop your investor costs. None of us knows the future for certain. Yet while you may not know the future, you sure as heck can know your costs today. Most mutual funds and annuities are high-cost breeders. Get rid of these leeches. You win every day by keeping your costs low.

- Armor-plate yourself against the taxman. Your best strategy is to hold trading to an absolute minimum. The mutual fund arena is fraught with trading excess. The average turnover rate is 80%, or more than 10 times what I target in my own account and advise for you. In every mutual fund’s annual and semiannual reports is a statistical display of portfolio turnover. Aim for 40% or less for your CORE funds. Don’t forget, each time a mutual fund manager sells a stock at a profit, you get a tax bill. These guys invest with no regard for your tax bill or your devotion to compound interest. You simply cannot pay enough attention to mutual fund portfolio turnover.

- Diversify, diversify, diversify. Proper diversification will help you sleep well during bear stock markets. We have not seen a bear market in years, and we are all, quite honestly, spoiled. Today is a dangerous time in the annals of the stock market and the least safe time in the last 16 years to be inadequately diversified. Sooner or later, the music will stop, and you do not want to be the one left without a chair. You want to properly diversify yourself before it’s too late. You will never regret your diligence.

Action Line: When you want to talk about the financial armadillo strategy, email me at ejsmith@yoursurvivalguy.com. Click here to subscribe to my free monthly Survive & Thrive letter.

Originally posted on Your Survival Guy.