Not to beat a dead horse, but Your Survival Guy understands how hard it is to beat inertia and do what you know is right. I’m talking about your retirement life and creating a plan you can live with, with the peace of mind and comfort you deserve. I’m talking about crafting a diversified, balanced portfolio, something Ben Graham would suggest lies somewhere between 70 to 30 percent in stocks.

Your Survival Guy isn’t interested in “beating” the market. I pay scant attention to benchmarks. That doesn’t mean I don’t know the score. I do. And then some. Bonds are having their best year since 2020. A balanced portfolio is coming pretty darn close to beating, if not beating, the Dow Jones Industrial Average. Stay tuned.

The reason I like bonds is that, historically speaking, they can smooth out returns, helping investors sleep well at night rather than being forced to sell their stocks until they can sleep. And anyone who says sleep is overrated hasn’t had their life savings invested all in stocks during a market crash.

But that’s not what this morning is all about. It’s about an email I received over the weekend from a reader suggesting more be invested in stocks, 100%, because the money is going to his children—it’s a legacy portfolio.

And my stance remains the same. I want you to invest for your retirement life and for your life, period. Because the fastest way to gift your kids $1 million is to start with $2 million.

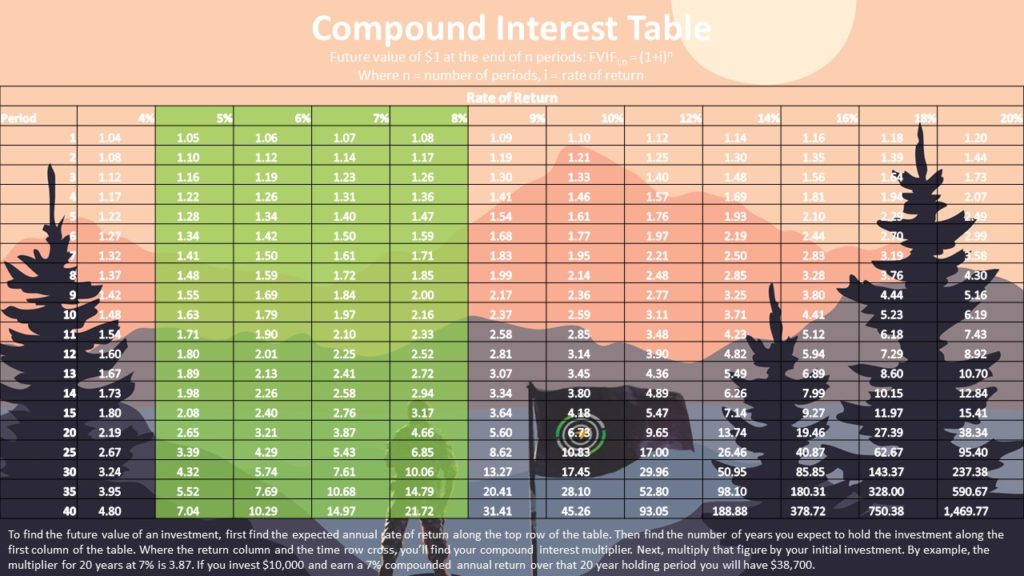

Action Line: Your job is not about how much money you leave to your children (maybe a little bit). Your job is to educate them about money, so when they get their hands on it, they don’t blow it. The gift that keeps on giving will always be compound interest. When you want to talk about your portfolio, your kids, and compound interest, email me at ejsmith@yoursurvivalguy.com. And click here to subscribe to my free monthly Survive & Thrive letter.

Originally posted on Your Survival Guy.