The Trump Administration Wants to Lower Corporate Taxes

Newly installed Treasury Secretary Steven Mnuchin has said in an interview with CNBC that he wants to get a “very significant” tax reform bill passed by Congress before the legislature goes to recess in August. Mnuchin told interviewers that his focus is on making “the business tax competitive with the rest of the world.” The rate now is anything but competitive.

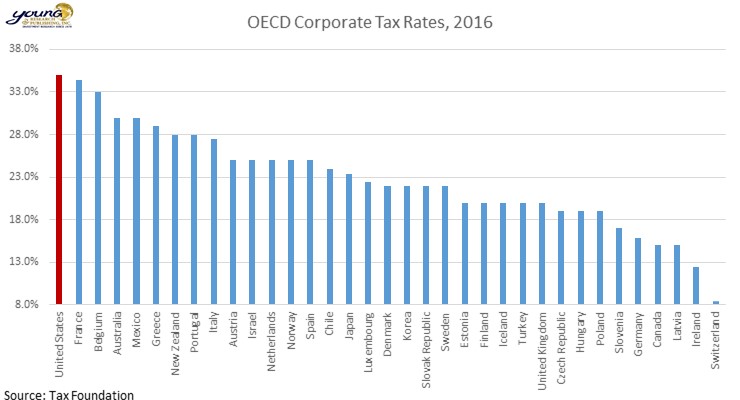

America Has the Highest Corporate Tax Rate Among the OECD

Today the United State’s corporate tax rate is the highest among the world’s advanced economies. The average rate among OECD countries in 2016 was 22.8%. The U.S. statutory rate sat at 35%, while additional state corporate tax rates pushed the combined rate up to 38.92%, over 14 points higher than the average combined rate of 24.66%. High rates can hurt employment and incomes.

High Corporate Tax rates Hurt Employment and Income

A study done in 2015 by Federal Reserve economists found that “increases in corporate tax rates lead to significant reductions in employment and income.” The same study found that corporate tax cuts didn’t appear to have significant effects on job growth unless they were made during a recession, at which point they did meaningfully impact job creation. But the authors also noted that the cuts they observed in their state level study weren’t nearly of the magnitude of those being proposed at the federal level. There is more evidence to suggest that workers bear the brunt of high rates.

The Effects of High Corporate Tax Rates Fall On Workers

The Effects of High Corporate Tax Rates Fall On Workers

In 2008, Cato Institute senior fellows Chris Edwards and Dan Mitchell literally wrote the book on how high corporate taxes are harming workers. In their book Global Tax Revolution, Edwards and Mitchell explain that “The burden of corporate taxes in the globalized economy mainly falls on average workers in the form of lower wages. If U.S. and foreign semiconductor and pharmaceutical companies are not building factories in America because of higher taxes, it is American workers who lose.”

Lower Corporate Tax Rates Could Lead to More Revenue

Late last year Barron’s updated Edwards’ and Mitchell’s statistical analysis and found that the data confirmed the so-called “Laffer effect,” named after Arthur Laffer, a former Reagan administration Economic Policy Advisor who theorized that lower corporate tax rates can sometimes generate increased government revenue. According to Barron’s, the statistical update “not only confirmed the Laffer effect but if anything, showed that a decline in the corporate tax rate seems to bring a rise in revenue, rather than a fall. In other words, instead of being revenue-neutral, the proposed cut might even be revenue-positive.”

Can Tax Rates Be Cut By August?

The last major overhaul of the tax code happened during the Reagan-era with The Tax Reform Act of 1986. The deal took two years to hammer out. The Trump administration may have an advantage over Reagan in that it is dealing with a legislature controlled by its own party, while the Gipper had to compromise with Democrats in the Capitol. But no matter who controls government, tax reform is a very complex task with very powerful, competing stakeholders who will undoubtedly lobby hard to change the legislation, or even kill it. Even with single party rule, it may take a long time to produce, or may never happen at all.