President Donald J. Trump signs a Presidential memorandum for continued student loan payment relief during the COVID-19 pandemic Saturday, Aug. 8, 2020, at a news conference in Bedminster, N.J. (Official White House Photo by Shealah Craighead)

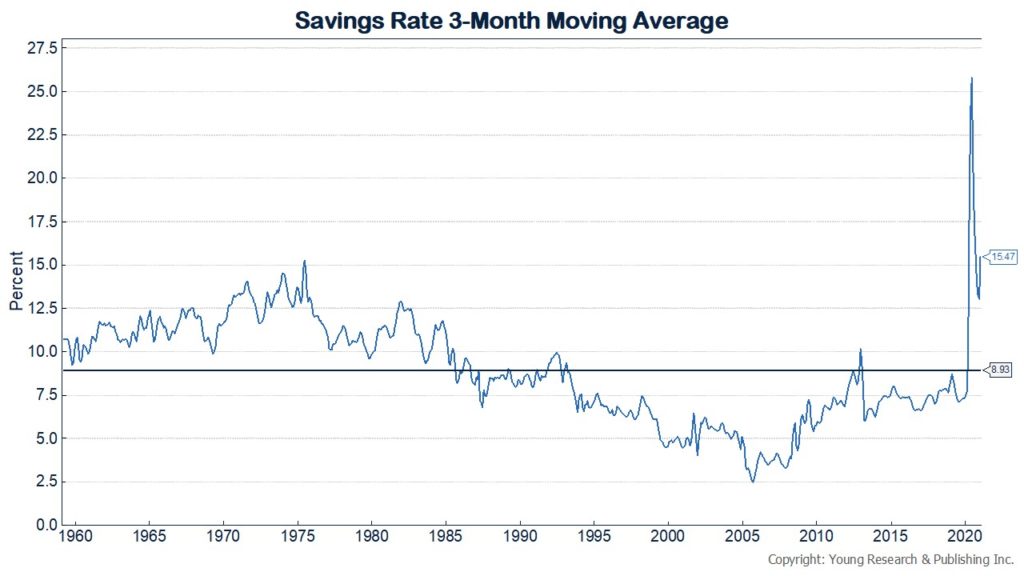

Actions taken during the Trump administration have pumped Americans’ personal savings rate up to levels not seen since the mid-1970s. All that money could provide the foundation of a powerful consumer boom in the years to come. The WSJ reports:

Pandemic aid to households is pouring money into the U.S. economy, priming it for rapid growth this year.

Household income—the amount Americans received from wages, investments and government programs—rose 10% in January from the previous month, the Commerce Department said Friday. The increase was the second largest on record, eclipsed only by last April’s gain, when the federal government sent an initial round of pandemic-relief payments. Household income has risen 13% since February 2020, the month before the pandemic shut down large segments of the economy.

January’s increase in household income was almost entirely due to federal pandemic-relief aid included in a $900 billion stimulus program signed into law in late December. That package included one-time cash payments of $600 and a special weekly unemployment benefit of $300 that the government started sending to households.

There will likely be more government money flowing into the economy soon. The Democratic-led House on Friday was expected to narrowly pass a $1.9 trillion Covid-19 aid bill that would extend additional pandemic aid, including $1,400 per-person payments for many Americans. It would then go to the Senate, where Democrats hope to pass the package through a procedure that doesn’t require votes from Republicans, who have attacked it as too large.

Americans last month spent a chunk of their income, boosting spending by 2.4%, the first gain in three months. Households spent broadly on goods, particularly long-lasting big-ticket items. Spending on services also increased for the first time since October.

But households also stashed much of the money: Household savings totaled $3.9 trillion last month, up from $1.4 trillion last February.

“The levels are off the charts,” Joseph Brusuelas, chief economist at RSM US LLP, said of the cash reserves. “You’re going to see the fuel for a pretty big consumer-led boom this year, which will spill into next.” He expects the economy to grow 6.5% or more this year.

If you’re willing to fight for Main Street America, click here to sign up for the Richardcyoung.com free weekly email.