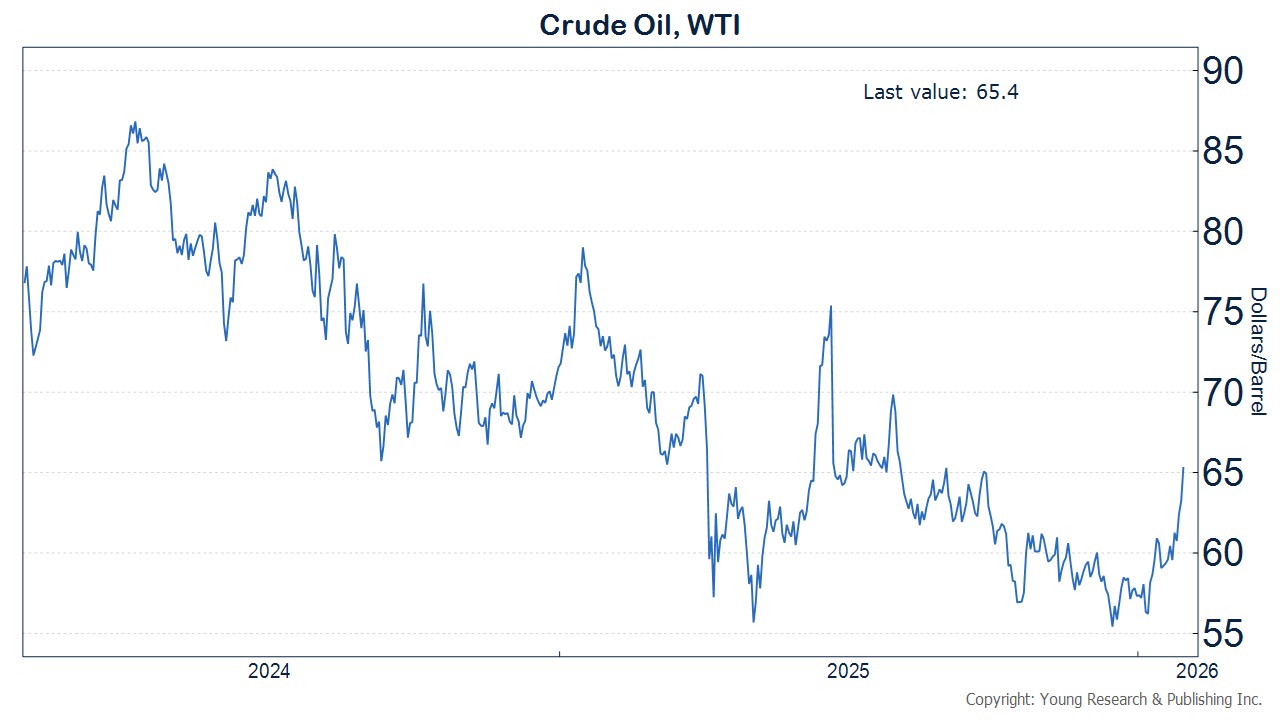

President Trump has been working in a variety of ways to push down the price of oil. Expressly urging OPEC to boost oil production, and taking military action to intervene in oil-rich Venezuela, have added downward pressure to oil prices. Prices for WTI crude oil fell throughout 2025 to as low as $55.40/barrel in mid-December. That’s down from $79/barrel shortly before Trump took office.

In response to what appears to be impending military action against Iran, prices have jumped back up over $65/barrel.

That will be a relief for big oil companies that have been hit somewhat by the declinein prices for crude. The Wall Street Journal’s Collin Eaton explains:

America’s two largest oil companies on Friday posted their smallest annual profits since 2021, pressured by a growing glut of crude that has weighed on prices.

Exxon Mobil and Chevron also reported their fourth-quarter earnings declined year over year, though both companies increased oil-and-gas production.

Oil prices began sinking shortly after President Trump returned to office and urged the Saudi Arabia-led Organization of the Petroleum Exporting Countries to boost oil production in an already well-supplied global oil market.

U.S. oil prices ended 2025 down 20% at $57.42 a barrel, and have since climbed back above $65. Despite the slide, Exxon and Chevron’s shares have risen nearly 30% and 10%, respectively, over the past year.

Read more here.