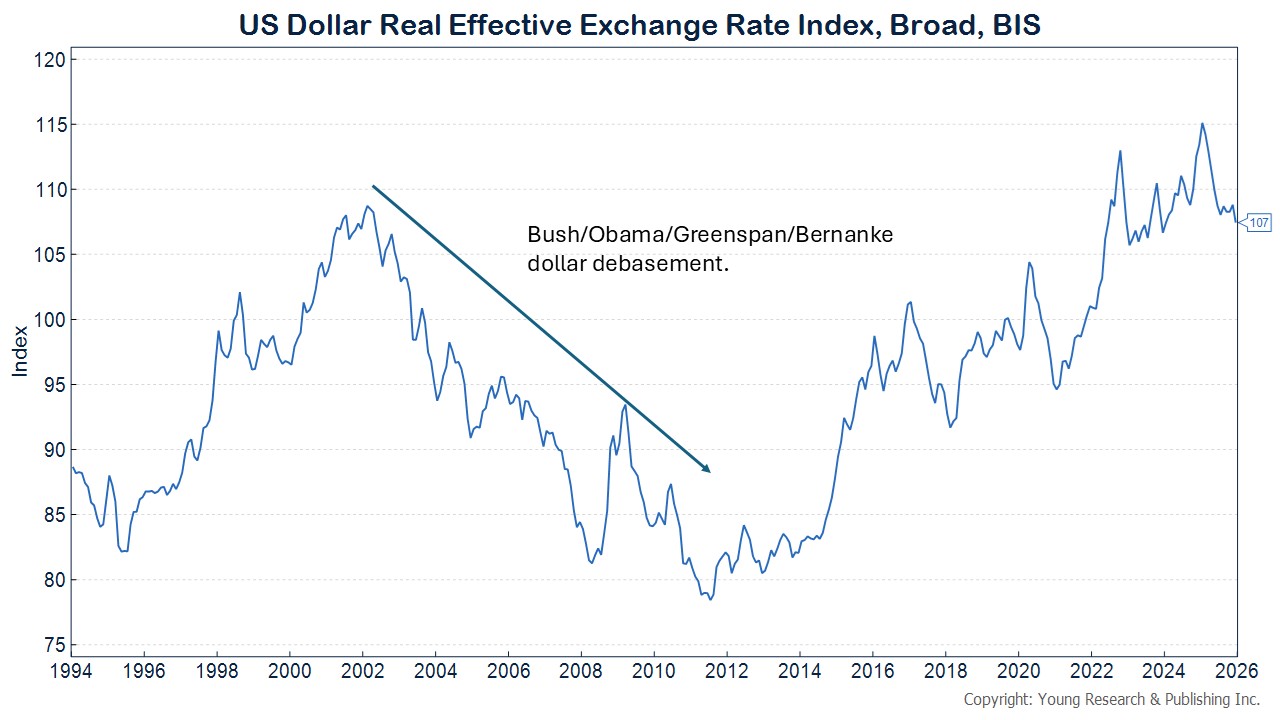

There has been a lot of discussion in the financial news media over the decline of the dollar, and certainly America’s rapidly increasing debt and inflation have added risk to the currency, but the dollar’s decline since its peak at the start of 2025 doesn’t appear to be at crisis levels, just yet. Take a look at my chart below of the Bank of International Settlements’ Real Effective Exchange Rate Index (broad) for the dollar.

In the chart, you can see larger moves in the dollar compared to what has happened over the last year. The most significant is that which occurred from February 2002, bottoming out in July 2011.

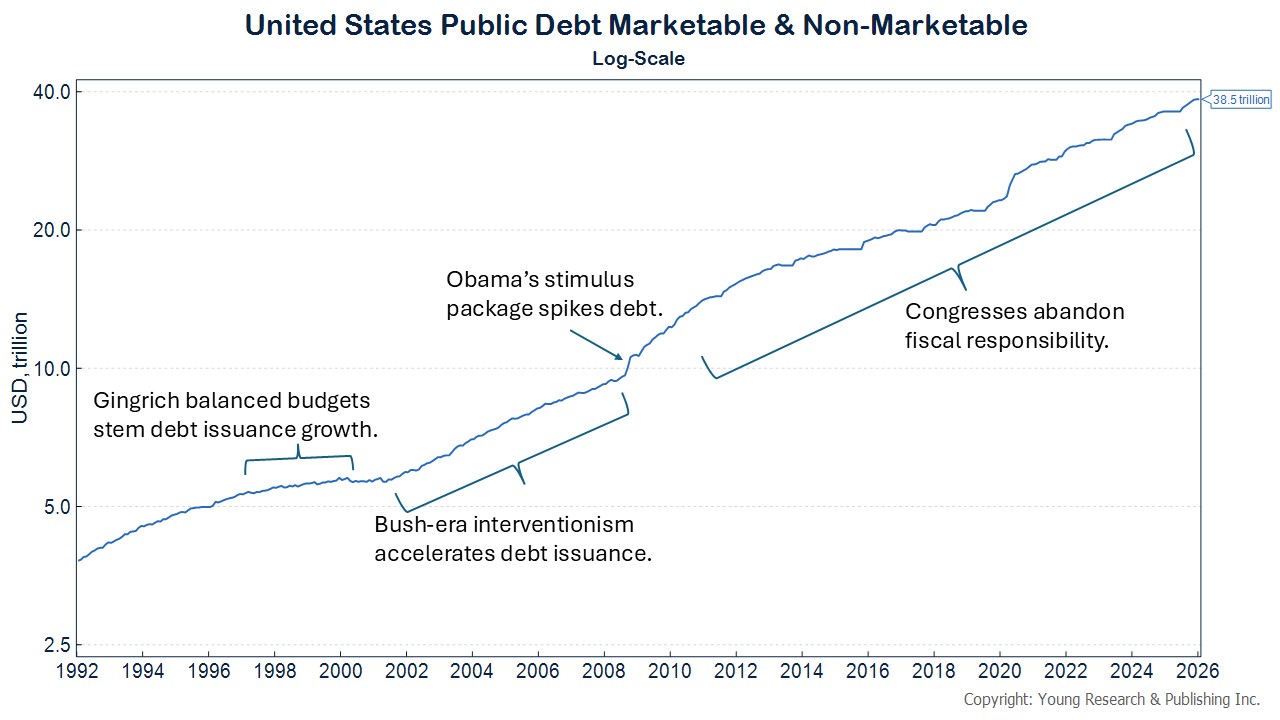

A number of factors contributed to the long decline of the dollar from 2002, including somewhat the uptake in the use of the euro, but mostly loose monetary policy and aggressive nation-building policies by the Bush administration and the so-called “stimulus” by the Obama administration, both of which demanded massive federal spending and debt issuance to fund. After the financial crisis hooked the government on debt, subsequent Congresses seemed to abandon fiscal responsibility altogether.

The dollar isn’t dead yet, but if politicians and Federal Reserve officials are sincere in their stated commitments to a strong dollar, they will maintain reasonable interest rates and forgo drastic interventions in the economy and abroad.

Originally posted on Young’s World Money Forecast.