At the Cato Institute, scholars Jeffrey Miron and Erin Partin explain that Joe Biden’s massive budget is adding to an already unsustainable course of spending set by America’s so-called “entitlements,” Social Security, and Medicare. They write (abridged):

This article appeared on Real Clear Policy on May 25, 2021.

Current concern about the U.S. fiscal outlook targets recent COVID-19 stimulus legislation: the already adopted CPRSAA ($8.3 billion), FFCRA ($192 billion), CARES Act ($2.2 trillion), PPPHCEA ($484 billion), CAA ($915 billion), and ARP ($1.9 trillion); plus the proposed but not yet adopted AJP ($2.7 trillion) and AFP ($1.8 trillion). All together, these programs add (at least) $5.7 trillion to the federal debt.

That sounds huge, and it is.

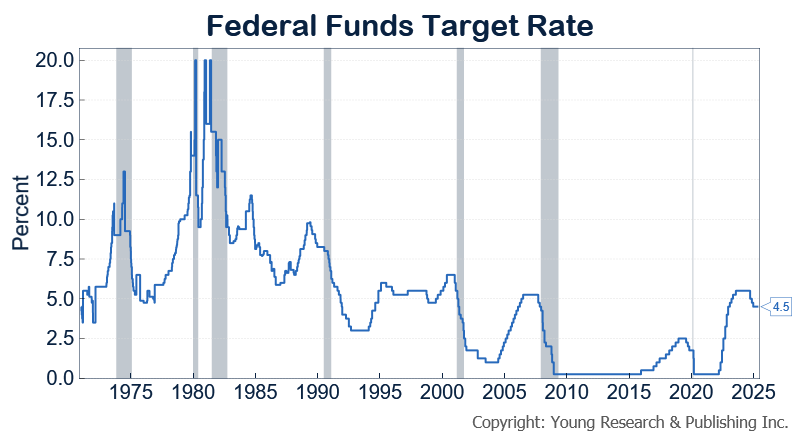

But recent fiscal expansions are not the major reason for US fiscal imbalance. These measures are mainly one offs, so GDP growth will gradually make them insignificant relative to the overall economy. So long as the non‐interest deficit does not grow relative to GDP, and interest rates do not spike, the U.S. can pay off even a huge spending binge, as it did after WWII when the debt to GDP ratio fell from 118 percent in 1948 to 40 percent by the mid‐1960s.

The far more important fiscal issue is that pre‐COVID‐19 entitlement programs — chiefly Medicare and Social Security — set the U.S. on an unsustainable fiscal path long before the pandemic.

By Jeffrey Miron and Erin Partin.

Read more here.

If you’re willing to fight for Main Street America, click here to sign up for my free weekly email.