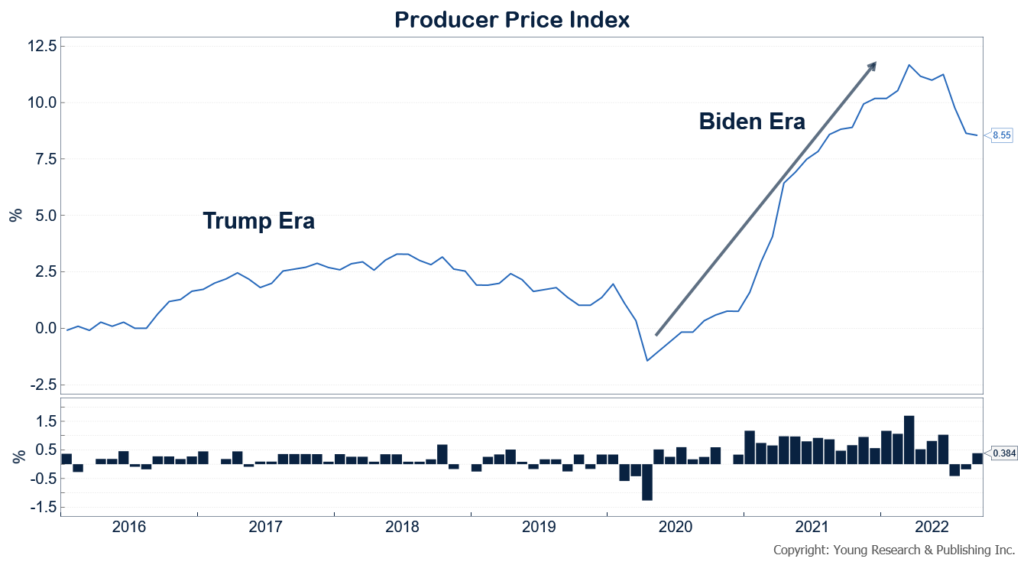

After what looked like a respite, Producer Price Inflation has surged again, damping optimism in some corners that the Federal Reserve might slow down its rate cuts, or that Americans may see reduced prices. CNBC’s Jeff Cox reports:

Wholesale prices rose more than expected in September despite Federal Reserve efforts to control inflation, according to a report Wednesday from the Bureau of Labor Statistics.

The producer price index, a measure of prices that U.S. businesses get for the goods and services they produce, increased 0.4% for the month, compared with the Dow Jones estimate for a 0.2% gain. On a 12-month basis, PPI rose 8.5%, which was a slight deceleration from the 8.7% in August.

Excluding food, energy and trade services, the index increased 0.4% for the month and 5.6% from a year ago, the latter matching the August increase.

Food prices helped boost the increase in goods inflation, with a 1.2% monthly increase. Energy rose 0.7% after posting massive gains the previous two months.

Inflation has been the economy’s biggest issue over the past year as the cost of living is running near its highest level in more than 40 years.

The Fed has responded by raising rates five times this year for a total of 3 percentage points and is widely expected to implement a fourth consecutive 0.75 percentage point increase when it meets again in three weeks.

“Inflationary momentum has built up in the U.S. economy and will persist near-term, keeping the Fed hiking aggressively,” said Bill Adams, chief economist for Comerica Bank.

If you’re willing to fight for Main Street America, click here to sign up for the Richardcyoung.com free weekly email.