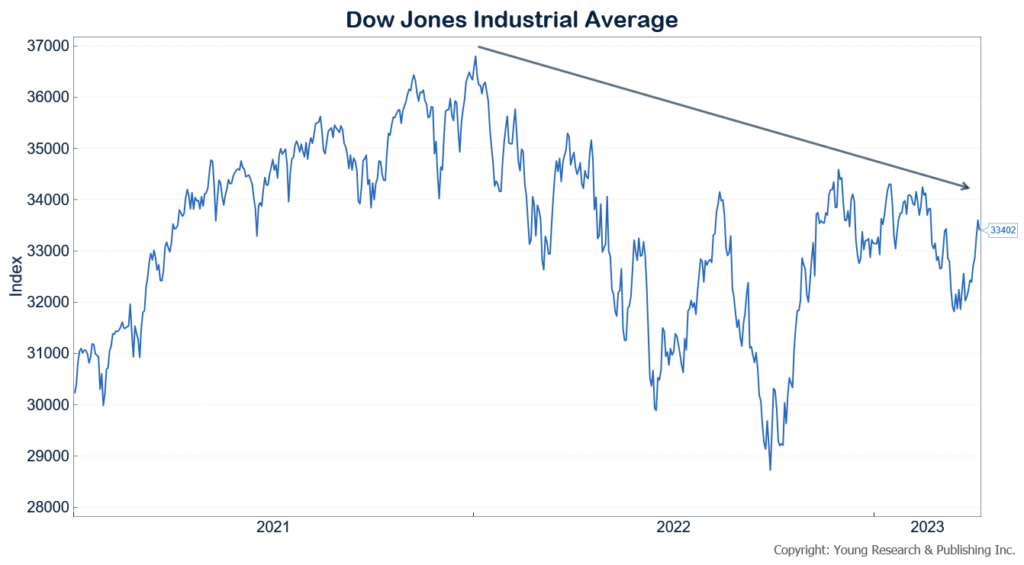

UPDATE 4.5.2023: The Dow Jones Industrial Average closed at 33,402.38 yesterday. That’s down 9.2% from a peak of 36,799.65 on January 1, 2022. The traditional definition of a market correction is a 10% decline from peak. Speculators relying on price appreciation may be concerned. Investors focused on developing a steady stream of income are still collecting their dividends.

Update 2.22.2021: The Dow Jones Industrial Average Index closed at 31,494.32.

Originally posted August 3, 2018.

This week a long-time reader contacted me looking for some insight he could pass along to his children about the dangers of market timing. I’ve written on the topic many times over the years and wanted to share something he might find compelling. In April of 1996, I wrote about how three of Wall Street’s bright minds had completely failed while attempting to make market timing predictions about the future of the Dow Jones Industrial Index. Back then, my advice was—as it is now—marry compound interest, divorce market timing. I wrote:

Market timing is a bankrupt strategy whose time has never come. The following three market predictions will alarm you. (Keep in mind, the Dow is now over 5500!) (1) On 24 February 1995, from the head of a major Wall Street investment management firm, “We won’t materially break 4000 until well into the next millennium.” (2) On the same date, from the head of institutional equities at a major brokerage firm, “Dow 5000 is not going to happen in my lifetime.” He’s still alive as far as I know. (3) On 25 May 1995, from a well-known market cycles technician, “This high (Dow) represents a gift last-chance selling opportunity (Dow 4500) before the big bear growls at the Dow. We expect the largest decline in stock prices since 1990.” Each of these forecasts was a disaster, of course, and cost followers of this advice a bundle in missed opportunity.

I have never in 32 years of investing suffered so much as one significant loss—not one. This is because I invest for the long term keyed to harnessing the awesome power of compound interest. The key to Warren Buffett’s long-term success has been buying easy-to-understand companies with unmatchable franchises and holding for the long term to allow the miracle of compound interest to do its work. If you marry compound interest and divorce market timing, you will find prosperity beyond your wildest dreams. If I can help you in only one way in your personal investing, it is to first and foremost harness the awesome power of compound interest through low-turnover, low-cost, long-term investing.

By the end of 1996, the Dow was trading well above 6400 and has never fallen below 6000 again. The market timers’ predictions were completely wrong. Building a strategy based on compound interest and regular streams of income in your portfolio was absolutely right.

Ken, I hope that helps, and thanks for all the years of loyalty. After over five decades, I haven’t changed my investing strategy, and I hope you won’t either if you’re investing along with me.

Originally posted on Young’s World Money Forecast.

If you’re willing to fight for Main Street America, click here to sign up for my free weekly email.