Follow Us:

The RIP Map

Rhode Island Pensions

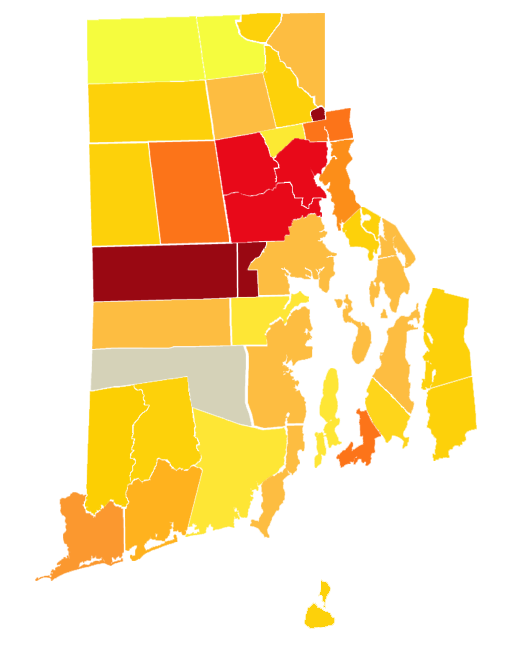

If you thought your state was in trouble take a look at Rhode Island. Here's our proprietary on the ground-intelligence on the truly dismal numbers. Click on the images of Rhode Island's towns and cities below to view information about their finances, people, government, and taxes. The municipalities are colored according to their adjusted funding ratios. The ratio measures how well the towns and cities have financed their pension plans, on a scale from 0% to 100%. On our map, the closer to the color red a town gets, the worse its pension is funded. As you can see, none of Rhode Island's municipalities is colored green. The facts on the ground are terrifying.

Rhode Island Pensions

If you thought your state was in trouble take a look at Rhode Island. Here's our proprietary on the ground-intelligence on the truly dismal numbers. Click on the images of Rhode Island's towns and cities below to view information about their finances, people, government, and taxes. The municipalities are colored according to their adjusted funding ratios. The ratio measures how well the towns and cities have financed their pension plans, on a scale from 0% to 100%. On our map, the closer to the color red a town gets, the worse its pension is funded. As you can see, none of Rhode Island's municipalities is colored green. The facts on the ground are terrifying.

Tax Rates:

(Per $1k of assessed value)

RRE: $18.88

COMM: $18.88

PP: $18.88

MV: $40.00

(Per $1k of assessed value)

RRE: $18.88

COMM: $18.88

PP: $18.88

MV: $40.00

Adjusted Funding Ratio: 50.30%

Burrillville

50.30%

People:

2013 Population Est:16,109

10-Year Pop. Growth: 1.0%

Unemployment Rate: 6.0%

Finance:

(Pension+Debt)/Receipts: 126%

Debt/Capita: $3991.91

Pension Liability: $30,680,000

2013 Population Est:16,109

10-Year Pop. Growth: 1.0%

Unemployment Rate: 6.0%

Finance:

(Pension+Debt)/Receipts: 126%

Debt/Capita: $3991.91

Pension Liability: $30,680,000

Mayor or Equivalent:

John F. Pacheco, III

105 Harrisville Main Street

Burriville, RI 02830

Phone: 401-568-2007

Email: Johnp-cbs@verizon.net

John F. Pacheco, III

105 Harrisville Main Street

Burriville, RI 02830

Phone: 401-568-2007

Email: Johnp-cbs@verizon.net

Sources and Notes:

Municipal tax rates from the Rhode Island Economic Development Corp:

Rhode Island Economic Development Corporation. "FY 2015 Tax Rates by Class of Property: Rhode Island."

Population statistics from the I Rhodesland Department of Labor and Training: Rhode Island Department of Labor and Training. "Rhode Island City and Town Resident Population Estimates." July 1, 2013 Estimates.

Unemployment rates from the Rhode Island Department of Labor and Training: Rhode Island Department of Labor and Training. Employment Bulletin. December 2014.

Finance totals from the Mercatus Center, George Mason University:

Norcross, E., and B. VanMetre. "Rhode Island's Local Pension Debts." Working paper, Mercatus Center, George Mason University, 2011.

Note about municipal tax rates:

RRE = residential real estate,

COMM = commercial real estate,

PP = personal property,

MV = motor vehicle

* Also, see the RIEDC website for specific notes on towns' tax rates.

Note about population growth:

The population growth number represents the last 10 years of growth for the town.

Note on finance statistics:

The adjusted funding ratio shown is the result of a calculation done by Eileen Norcross and Benjamin VanMetre of the Mercatus Center at George Mason University that divides towns' pension plan assets by the market value of their liabilities.

Municipal tax rates from the Rhode Island Economic Development Corp:

Rhode Island Economic Development Corporation. "FY 2015 Tax Rates by Class of Property: Rhode Island."

Population statistics from the I Rhodesland Department of Labor and Training: Rhode Island Department of Labor and Training. "Rhode Island City and Town Resident Population Estimates." July 1, 2013 Estimates.

Unemployment rates from the Rhode Island Department of Labor and Training: Rhode Island Department of Labor and Training. Employment Bulletin. December 2014.

Finance totals from the Mercatus Center, George Mason University:

Norcross, E., and B. VanMetre. "Rhode Island's Local Pension Debts." Working paper, Mercatus Center, George Mason University, 2011.

Note about municipal tax rates:

RRE = residential real estate,

COMM = commercial real estate,

PP = personal property,

MV = motor vehicle

* Also, see the RIEDC website for specific notes on towns' tax rates.

Note about population growth:

The population growth number represents the last 10 years of growth for the town.

Note on finance statistics:

The adjusted funding ratio shown is the result of a calculation done by Eileen Norcross and Benjamin VanMetre of the Mercatus Center at George Mason University that divides towns' pension plan assets by the market value of their liabilities.

Mayor or Equivalent:

June Sager Speakman

283 County Road

Barrington, RI 02806

Phone: 401-247-1900

Email:jspeakman@barrington.ri.gov

June Sager Speakman

283 County Road

Barrington, RI 02806

Phone: 401-247-1900

Email:jspeakman@barrington.ri.gov

Adjusted Funding Ratio: 44.60%

Barrington

44.60%

People:

2013 Population Est:16,293

10-Year Pop. Growth: -3.0%

Unemployment Rate: 5.0%

Finance:

(Pension+Debt)/Receipts: 129%

Debt/Capita: $5,224.40

Pension Liability: $56,264,000

2013 Population Est:16,293

10-Year Pop. Growth: -3.0%

Unemployment Rate: 5.0%

Finance:

(Pension+Debt)/Receipts: 129%

Debt/Capita: $5,224.40

Pension Liability: $56,264,000

Tax Rates:

(Per $1k of assessed value)

RRE: $18.30

COMM: $18.30

PP: $18.30

MV: $42.00

(Per $1k of assessed value)

RRE: $18.30

COMM: $18.30

PP: $18.30

MV: $42.00

Mayor or Equivalent:

Antonio "Tony" A. Teixeira

10 Court Street

Bristol, RI 02809

Phone: 401-253-7000

Email: Contact Page

Antonio "Tony" A. Teixeira

10 Court Street

Bristol, RI 02809

Phone: 401-253-7000

Email: Contact Page

Tax Rates:

(Per $1k of assessed value)

RRE: $13.06

COMM: $13.06

PP: $13.06

MV: $17.35

(Per $1k of assessed value)

RRE: $13.06

COMM: $13.06

PP: $13.06

MV: $17.35

Adjusted Funding Ratio: 36.80%

Bristol

36.80%

People:

2013 Population Est: 22,385

10-Year Pop. Growth: 2.2%

Unemployment Rate: 5.7%

Finance:

(Pension+Debt)/Receipts: 237%

Debt/Capita: $4,175.22

Pension Liability: $53,167,000

2013 Population Est: 22,385

10-Year Pop. Growth: 2.2%

Unemployment Rate: 5.7%

Finance:

(Pension+Debt)/Receipts: 237%

Debt/Capita: $4,175.22

Pension Liability: $53,167,000

Mayor or Equivalent:

James Diossa

580 Broad Street

Central Falls, RI 02863

Phone: 401-727-7474

Email:mayor@centralfallsri.us

James Diossa

580 Broad Street

Central Falls, RI 02863

Phone: 401-727-7474

Email:mayor@centralfallsri.us

Tax Rates:

(Per $1k of assessed value)

RRE: 27.26

COMM: 39.48

PP: 73.11

MV: 48.65

(Per $1k of assessed value)

RRE: 27.26

COMM: 39.48

PP: 73.11

MV: 48.65

Adjusted Funding Ratio: 11.90%

11.90%

People:

2013 Population Est:19,416

10-Year Pop. Growth: 2.4%

Unemployment Rate: 8.2%

Finance:

(Pension+Debt)/Receipts: 788%

Debt/Capita: $7,664.53

Pension Liability: $95,438,000

2013 Population Est:19,416

10-Year Pop. Growth: 2.4%

Unemployment Rate: 8.2%

Finance:

(Pension+Debt)/Receipts: 788%

Debt/Capita: $7,664.53

Pension Liability: $95,438,000

Central Falls

Mayor or Equivalent:

Mark S. Stankiewicz

4540 South County Trail Charlestown, RI 02813

Phone: 401-364-1210

Email:

mstankiewicz@charlestownri.org

Mark S. Stankiewicz

4540 South County Trail Charlestown, RI 02813

Phone: 401-364-1210

Email:

mstankiewicz@charlestownri.org

People:

2013 Population Est: 7,781

10-Year Pop. Growth: -0.4%

Unemployment Rate: 5.7%

Finance:

(Pension+Debt)/Receipts: 101%

Debt/Capita: $3,152.55

Pension Liability: $19,017,000

2013 Population Est: 7,781

10-Year Pop. Growth: -0.4%

Unemployment Rate: 5.7%

Finance:

(Pension+Debt)/Receipts: 101%

Debt/Capita: $3,152.55

Pension Liability: $19,017,000

Adjusted Funding Ratio: 35.60%

Charlestown

35.60%

Tax Rates:

(Per $1k of assessed value)

RRE: $9.90

COMM: $9.90

PP: $9.90

MV: $13.08

(Per $1k of assessed value)

RRE: $9.90

COMM: $9.90

PP: $9.90

MV: $13.08

Mayor or Equivalent:

Thomas R. Hoover

1670 Flat River Road

Coventry, RI 02816

Phone: 401-822-9185

Email:

thoover@town.coventry.ri.us

Thomas R. Hoover

1670 Flat River Road

Coventry, RI 02816

Phone: 401-822-9185

Email:

thoover@town.coventry.ri.us

Tax Rates:

(Per $1k of assessed value) RRE: $20.40

COMM: $24.58

PP: $20.40

MV: $18.75

(Per $1k of assessed value) RRE: $20.40

COMM: $24.58

PP: $20.40

MV: $18.75

People:

2013 Population Est: 34,935

10-Year Pop. Growth: 4.0%

Unemployment Rate: 5.6%

Finance:

(Pension+Debt)/Receipts: 136%

Debt/Capita: $3,777.17

Pension Liability: $88,001,000

2013 Population Est: 34,935

10-Year Pop. Growth: 4.0%

Unemployment Rate: 5.6%

Finance:

(Pension+Debt)/Receipts: 136%

Debt/Capita: $3,777.17

Pension Liability: $88,001,000

Adjusted Funding Ratio: 11.50%

Coventry

11.50%

Mayor or Equivalent:

Allan Fung

869 Park Avenue

Cranston, RI 02910

Phone: 401-461-1000

Allan Fung Contact Page

Allan Fung

869 Park Avenue

Cranston, RI 02910

Phone: 401-461-1000

Allan Fung Contact Page

People:

2013 Population Est: 80,566

10-Year Pop. Growth: 1.4%

Unemployment Rate: 6.6%

Finance:

(Pension+Debt)/Receipts: 299%

Debt/Capita: $9,585.32

Pension Liability: $672,437,000

2013 Population Est: 80,566

10-Year Pop. Growth: 1.4%

Unemployment Rate: 6.6%

Finance:

(Pension+Debt)/Receipts: 299%

Debt/Capita: $9,585.32

Pension Liability: $672,437,000

Adjusted Funding Ratio: 24.70%

Cranston

24.70%

Tax Rates:

(Per $1k of assessed value)

RRE: $22.84

COMM: $34.26

PP: $34.26

MV: $42.44

(Per $1k of assessed value)

RRE: $22.84

COMM: $34.26

PP: $34.26

MV: $42.44

Mayor or Equivalent:

William S. Murray

45 Broad Street

Cumberland, RI 02864

Phone: 401-728-2400

Email:wmurray@cumberlandri.org

William S. Murray

45 Broad Street

Cumberland, RI 02864

Phone: 401-728-2400

Email:wmurray@cumberlandri.org

People:

2013 Population Est: 33,055

10-Year Pop. Growth: 5.2%

Unemployment Rate: 5.6%

Finance:

(Pension+Debt)/Receipts: 166%

Debt/Capita: $3,960.84

Pension Liability: $63,924,000

2013 Population Est: 33,055

10-Year Pop. Growth: 5.2%

Unemployment Rate: 5.6%

Finance:

(Pension+Debt)/Receipts: 166%

Debt/Capita: $3,960.84

Pension Liability: $63,924,000

Adjusted Funding Ratio: 34.40%

Cumberland

34.40%

Tax Rates:

(Per $1k of assessed value)

RRE: $17.08

COMM: $17.08

PP: $29.53

MV: $19.87

(Per $1k of assessed value)

RRE: $17.08

COMM: $17.08

PP: $29.53

MV: $19.87

Mayor or Equivalent:

Thomas E. Coyle, III

125 Main Street

East Greenwich, RI 02818

Phone: 401-886-8665

Email:

tcoyle@eastgreenwhichri.com

Thomas E. Coyle, III

125 Main Street

East Greenwich, RI 02818

Phone: 401-886-8665

Email:

tcoyle@eastgreenwhichri.com

People:

2013 Population Est: 13,131

10-Year Pop. Growth: 1.5%

Unemployment Rate: 5.7%

Finance:

(Pension+Debt)/Receipts: 248%

Debt/Capita: $9,734.98

Pension Liability: $41,716,000

2013 Population Est: 13,131

10-Year Pop. Growth: 1.5%

Unemployment Rate: 5.7%

Finance:

(Pension+Debt)/Receipts: 248%

Debt/Capita: $9,734.98

Pension Liability: $41,716,000

Adjusted Funding Ratio: 47.00%

East Greenwich

47.00%

Tax Rates:

(Per $1k of assessed value)

RRE: $23.26

COMM: $23.26

PP: $23.26

MV: $22.88

(Per $1k of assessed value)

RRE: $23.26

COMM: $23.26

PP: $23.26

MV: $22.88

Mayor or Equivalent:

Paul Lemont

145 Taunton Avenue East Providence, RI 02914

Phone: 401-435-7500

Email:

plemont@cityofeastprov.com

Paul Lemont

145 Taunton Avenue East Providence, RI 02914

Phone: 401-435-7500

Email:

plemont@cityofeastprov.com

People:

2013 Population Est: 47,149

10-Year Pop. Growth: -3.4%

Unemployment Rate: 7.1%

Finance:

(Pension+Debt)/Receipts: 239%

Debt/Capita: $7,131.75

Pension Liability: $279,619,000

2013 Population Est: 47,149

10-Year Pop. Growth: -3.4%

Unemployment Rate: 7.1%

Finance:

(Pension+Debt)/Receipts: 239%

Debt/Capita: $7,131.75

Pension Liability: $279,619,000

Adjusted Funding Ratio: 30.70%

East Providence

30.70%

Tax Rates:

(Per $1k of assessed value)

RRE: $22.95

COMM: $25.40

PP: $56.67

MV: $37.10

(Per $1k of assessed value)

RRE: $22.95

COMM: $25.40

PP: $56.67

MV: $37.10

Mayor or Equivalent:

Arlene B. Hicks

675 Ten Rod Road

Exeter, RI 02822

Phone: 401-295-7500

Email: Contact Email

Arlene B. Hicks

675 Ten Rod Road

Exeter, RI 02822

Phone: 401-295-7500

Email: Contact Email

People:

2013 Population Est: 6,546

10-Year Pop. Growth: 6.3%

Unemployment Rate: 5.9%

Finance:

(Pension+Debt)/Receipts: 14%

Debt/Capita: $311.44

Pension Liability: $0.00

2013 Population Est: 6,546

10-Year Pop. Growth: 6.3%

Unemployment Rate: 5.9%

Finance:

(Pension+Debt)/Receipts: 14%

Debt/Capita: $311.44

Pension Liability: $0.00

Adjusted Funding Ratio: NA

Exeter

NA

Tax Rates:

(Per $1k of assessed value)

RRE: $14.63

COMM: $14.63

PP: $14.63

MV: $32.59

(Per $1k of assessed value)

RRE: $14.63

COMM: $14.63

PP: $14.63

MV: $32.59

Mayor or Equivalent:

John L. Lewis, Jr.

181 Howard Hill

Foster, RI 02825

Phone: 401-392-9200

Email:jlewis8@netscape.com

John L. Lewis, Jr.

181 Howard Hill

Foster, RI 02825

Phone: 401-392-9200

Email:jlewis8@netscape.com

Tax Rates:

(Per $1k of assessed value)

RRE: $21.06

COMM: $21.06

PP: $28.96

MV: $36.95

(Per $1k of assessed value)

RRE: $21.06

COMM: $21.06

PP: $28.96

MV: $36.95

People:

2013 Population Est: 4,656

10-Year Pop. Growth: 7.8%

Unemployment Rate: 6.7%

Finance:

(Pension+Debt)/Receipts: 54%

Debt/Capita: $1,591.84

Pension Liability: $7,310,000

2013 Population Est: 4,656

10-Year Pop. Growth: 7.8%

Unemployment Rate: 6.7%

Finance:

(Pension+Debt)/Receipts: 54%

Debt/Capita: $1,591.84

Pension Liability: $7,310,000

Adjusted Funding Ratio: 41.00%

Foster

41.00%

Mayor or Equivalent:

Walter M. O. Steere, III

1145 Putnam Pike

Glocester, RI 02814

Phone: 401-568-6206

Email:Town Contact Page

Walter M. O. Steere, III

1145 Putnam Pike

Glocester, RI 02814

Phone: 401-568-6206

Email:Town Contact Page

People:

2013 Population Est: 9,854

10-Year Pop. Growth: -2.0%

Unemployment Rate: 4.6%

Finance:

(Pension+Debt)/Receipts: 74%

Debt/Capita: $2,193.52

Pension Liability: $15,981,000

2013 Population Est: 9,854

10-Year Pop. Growth: -2.0%

Unemployment Rate: 4.6%

Finance:

(Pension+Debt)/Receipts: 74%

Debt/Capita: $2,193.52

Pension Liability: $15,981,000

Adjusted Funding Ratio: 40.70%

Gloster

40.70%

Tax Rates:

(Per $1k of assessed value)

RRE: $21.77

COMM: $24.74

PP: $43.34

MV: $24.37

(Per $1k of assessed value)

RRE: $21.77

COMM: $24.74

PP: $43.34

MV: $24.37

Mayor or Equivalent:

William A. McGarry

One Town House Road

Hopkinton, RI 02833

Phone: 401-377-7761

Email:

townmanager@hopkintonri.org

William A. McGarry

One Town House Road

Hopkinton, RI 02833

Phone: 401-377-7761

Email:

townmanager@hopkintonri.org

Tax Rates:

(Per $1k of assessed value) RRE: $20.64

COMM: $20.64

PP: $20.64

MV: $21.18

(Per $1k of assessed value) RRE: $20.64

COMM: $20.64

PP: $20.64

MV: $21.18

People:

2013 Population Est: 8,116

10-Year Pop. Growth: 4.5%

Unemployment Rate: 5.1%

Finance:

(Pension+Debt)/Receipts: 54%

Debt/Capita: $1,580.85

Pension Liability: $10,780,000

2013 Population Est: 8,116

10-Year Pop. Growth: 4.5%

Unemployment Rate: 5.1%

Finance:

(Pension+Debt)/Receipts: 54%

Debt/Capita: $1,580.85

Pension Liability: $10,780,000

Adjusted Funding Ratio: 43.60%

Hopkinton

43.60%

Mayor or Equivalent:

Kristine S. Trocki

93 Narragansett Avenue Jamestown, RI 02835

Phone: 401-423-3390

Email:

trockijamestowntc@gmail.com

Kristine S. Trocki

93 Narragansett Avenue Jamestown, RI 02835

Phone: 401-423-3390

Email:

trockijamestowntc@gmail.com

Tax Rates:

(Per $1k of assessed value)

RRE: $8.75

COMM: $8.75

PP: $8.75

MV: $14.42

(Per $1k of assessed value)

RRE: $8.75

COMM: $8.75

PP: $8.75

MV: $14.42

People:

2013 Population Est: 5,472

10-Year Pop. Growth: -3.9%

Unemployment Rate: 4.4%

Finance:

(Pension+Debt)/Receipts: 197%

Debt/Capita: $7,972.99

Pension Liability: $20,719,000

2013 Population Est: 5,472

10-Year Pop. Growth: -3.9%

Unemployment Rate: 4.4%

Finance:

(Pension+Debt)/Receipts: 197%

Debt/Capita: $7,972.99

Pension Liability: $20,719,000

Adjusted Funding Ratio: 45.20%

Jamestown

45.20%

Mayor or Equivalent:

Joseph Polisena

1385 Hartford Avenue Johnston, RI 02919

Phone: 401-553-8800

Email: NA

Joseph Polisena

1385 Hartford Avenue Johnston, RI 02919

Phone: 401-553-8800

Email: NA

Tax Rates:

(Per $1k of assessed value)

RRE: $28.75

COMM: $28.75

PP: $59.22

MV: $41.46

(Per $1k of assessed value)

RRE: $28.75

COMM: $28.75

PP: $59.22

MV: $41.46

People:

2013 Population Est: 29,045

10-Year Pop. Growth: 2.0%

Unemployment Rate: 6.8%

Finance:

(Pension+Debt)/Receipts: 299%

Debt/Capita: $10,029.89

Pension Liability: $219,530,000

2013 Population Est: 29,045

10-Year Pop. Growth: 2.0%

Unemployment Rate: 6.8%

Finance:

(Pension+Debt)/Receipts: 299%

Debt/Capita: $10,029.89

Pension Liability: $219,530,000

Adjusted Funding Ratio: 22.70%

Johnston

22.70%

Mayor or Equivalent:

T. Joseph Almond

100 Old River Road

Lincoln, RI 02865

Phone: 401-333-8419

Email: jalmond@lincolnri.org

T. Joseph Almond

100 Old River Road

Lincoln, RI 02865

Phone: 401-333-8419

Email: jalmond@lincolnri.org

Tax Rates:

(Per $1k of assessed value)

RRE: $23.57

COMM: $26.94

PP: $37.02

MV: $30.66

(Per $1k of assessed value)

RRE: $23.57

COMM: $26.94

PP: $37.02

MV: $30.66

People:

2013 Population Est: 21,299

10-Year Pop. Growth: 1.0%

Unemployment Rate: 6.0%

Finance:

(Pension+Debt)/Receipts: 99%

Debt/Capita: $3,453.59

Pension Liability: $27,273,000

2013 Population Est: 21,299

10-Year Pop. Growth: 1.0%

Unemployment Rate: 6.0%

Finance:

(Pension+Debt)/Receipts: 99%

Debt/Capita: $3,453.59

Pension Liability: $27,273,000

Adjusted Funding Ratio: 39.90%

Lincoln

39.90%

Mayor or Equivalent:

Robert L. Mushen

The Commons, Box 226 Little Compton, RI 02837

Phone: 401-635-4400

Email: towncouncil@little-compton.com

Robert L. Mushen

The Commons, Box 226 Little Compton, RI 02837

Phone: 401-635-4400

Email: towncouncil@little-compton.com

Tax Rates:

(Per $1k of assessed value)

RRE: $5.64

COMM: $5.64

PP: $11.28

MV: $13.90

(Per $1k of assessed value)

RRE: $5.64

COMM: $5.64

PP: $11.28

MV: $13.90

People:

2013 Population Est: 3,503

10-Year Pop. Growth: -2.8%

Unemployment Rate: 5.7%

Finance:

(Pension+Debt)/Receipts: 83%

Debt/Capita: $2,711.34

Pension Liability: $8,563,000

2013 Population Est: 3,503

10-Year Pop. Growth: -2.8%

Unemployment Rate: 5.7%

Finance:

(Pension+Debt)/Receipts: 83%

Debt/Capita: $2,711.34

Pension Liability: $8,563,000

Adjusted Funding Ratio: 36.80%

Little Compton

36.80%

Mayor or Equivalent:

Shawn J. Brown

350 Main Road

Middletown, RI 02842

Phone: 401-849-2898

Email:

sbrown@middletownri.com

Shawn J. Brown

350 Main Road

Middletown, RI 02842

Phone: 401-849-2898

Email:

sbrown@middletownri.com

Tax Rates:

(Per $1k of assessed value)

RRE: $16.08

COMM: $21.34

PP: $16.07

MV: $16.05

(Per $1k of assessed value)

RRE: $16.08

COMM: $21.34

PP: $16.07

MV: $16.05

People:

2013 Population Est: 16,154

10-Year Pop. Growth: -6.8%

Unemployment Rate: 5.7%

Finance:

(Pension+Debt)/Receipts: 180%

Debt/Capita: $6,833.50

Pension Liability: $78,128,000

2013 Population Est: 16,154

10-Year Pop. Growth: -6.8%

Unemployment Rate: 5.7%

Finance:

(Pension+Debt)/Receipts: 180%

Debt/Capita: $6,833.50

Pension Liability: $78,128,000

Adjusted Funding Ratio: 42.00%

Middletown

42.00%

Mayor or Equivalent:

Pamela T. Nolan

25 Fifth Avenue Narragansett, RI 02885

Phone: 401-789-1044

Email:

pnolan@narragansettri.gov

Pamela T. Nolan

25 Fifth Avenue Narragansett, RI 02885

Phone: 401-789-1044

Email:

pnolan@narragansettri.gov

Tax Rates:

(Per $1k of assessed value)

RRE: $10.04

COMM: $15.06

PP: $15.06

MV: $16.46

(Per $1k of assessed value)

RRE: $10.04

COMM: $15.06

PP: $15.06

MV: $16.46

People:

2013 Population Est: 15,706

10-Year Pop. Growth: -3.0%

Unemployment Rate: 4.4%

Finance:

(Pension+Debt)/Receipts: 208%

Debt/Capita: $7,145.83

Pension Liability: $82,229,000

2013 Population Est: 15,706

10-Year Pop. Growth: -3.0%

Unemployment Rate: 4.4%

Finance:

(Pension+Debt)/Receipts: 208%

Debt/Capita: $7,145.83

Pension Liability: $82,229,000

Adjusted Funding Ratio: 39.50%

Narragansett

39.50%

Mayor or Equivalent:

Nancy O. Dodge

16 Old Town Road New Shoreham, RI 02807

Phone: 401-466-3210

Email: townmanager@new-shoreham.com

Nancy O. Dodge

16 Old Town Road New Shoreham, RI 02807

Phone: 401-466-3210

Email: townmanager@new-shoreham.com

Tax Rates:

(Per $1k of assessed value)

RRE: $5.34

COMM: $5.34

PP: $5.34

MV: $9.75

(Per $1k of assessed value)

RRE: $5.34

COMM: $5.34

PP: $5.34

MV: $9.75

People:

2013 Population Est: 1,041

10-Year Pop. Growth: 4.1%

Unemployment Rate: 15.3%

Finance:

(Pension+Debt)/Receipts: 280%

Debt/Capita: $29,583.25

Pension Liability: $7,898,000

2013 Population Est: 1,041

10-Year Pop. Growth: 4.1%

Unemployment Rate: 15.3%

Finance:

(Pension+Debt)/Receipts: 280%

Debt/Capita: $29,583.25

Pension Liability: $7,898,000

Adjusted Funding Ratio: 41.60%

New Shoreham

41.60%

Mayor or Equivalent:

Jeanne-Marie Napolitano

43 Broadway

Newport, RI 02840

Phone: 401-847-62

Email:

jnapolitano@cityofnewport.com

Jeanne-Marie Napolitano

43 Broadway

Newport, RI 02840

Phone: 401-847-62

Email:

jnapolitano@cityofnewport.com

Tax Rates:

(Per $1k of assessed value)

RRE: $12.06

COMM: $16.72

PP: $16.72

MV: $23.45

(Per $1k of assessed value)

RRE: $12.06

COMM: $16.72

PP: $16.72

MV: $23.45

People:

2013 Population Est: 24,027

10-Year Pop. Growth: -6.8%

Unemployment Rate: 6.5%

Finance:

(Pension+Debt)/Receipts: 324%

Debt/Capita: $13,296.17

Pension Liability: $286,990,000

2013 Population Est: 24,027

10-Year Pop. Growth: -6.8%

Unemployment Rate: 6.5%

Finance:

(Pension+Debt)/Receipts: 324%

Debt/Capita: $13,296.17

Pension Liability: $286,990,000

Adjusted Funding Ratio: 29.20%

Newport

29.20%

Mayor or Equivalent:

Michael Embury

80 Boston Neck Road

North Kingstown, RI 02852

Phone: 401-268-1501

Email: membury@northkingstown.org

Michael Embury

80 Boston Neck Road

North Kingstown, RI 02852

Phone: 401-268-1501

Email: membury@northkingstown.org

Tax Rates:

(Per $1k of assessed value)

RRE: $18.91

COMM: $18.91

PP: $18.91

MV: $22.04

(Per $1k of assessed value)

RRE: $18.91

COMM: $18.91

PP: $18.91

MV: $22.04

People:

2013 Population Est: 26,184

10-Year Pop. Growth: 0.6%

Unemployment Rate: 5.1%

Finance:

(Pension+Debt)/Receipts: 203%

Debt/Capita: $7,249.75

Pension Liability: $134,272,000

2013 Population Est: 26,184

10-Year Pop. Growth: 0.6%

Unemployment Rate: 5.1%

Finance:

(Pension+Debt)/Receipts: 203%

Debt/Capita: $7,249.75

Pension Liability: $134,272,000

Adjusted Funding Ratio: 38.30%

North Kingstown

38.30%

Mayor or Equivalent:

Charles A. Lombardi

2000 Smith Street North Providence, RI 02911

Phone: 401-232-0900

Email:

mayorsoffice@northprovidenceri.gov

Charles A. Lombardi

2000 Smith Street North Providence, RI 02911

Phone: 401-232-0900

Email:

mayorsoffice@northprovidenceri.gov

Tax Rates:

(Per $1k of assessed value)

RRE: $27.94

COMM: $34.68

PP: $69.91

MV: $41.95

(Per $1k of assessed value)

RRE: $27.94

COMM: $34.68

PP: $69.91

MV: $41.95

People:

2013 Population Est: 32,238

10-Year Pop. Growth: -1.0%

Unemployment Rate: 6.8%

Finance:

(Pension+Debt)/Receipts: 129%

Debt/Capita: $3,559.64

Pension Liability: $86,803,000

2013 Population Est: 32,238

10-Year Pop. Growth: -1.0%

Unemployment Rate: 6.8%

Finance:

(Pension+Debt)/Receipts: 129%

Debt/Capita: $3,559.64

Pension Liability: $86,803,000

Adjusted Funding Ratio: 46.10%

North Providence

46.10%

Mayor or Equivalent:

Paulette D. Hamilton

Main Street North

Smithfield, RI 02876

Phone: 401-767-2200

Email:

phamilton@nsmithfieldri.org

Paulette D. Hamilton

Main Street North

Smithfield, RI 02876

Phone: 401-767-2200

Email:

phamilton@nsmithfieldri.org

Tax Rates:

(Per $1k of assessed value)

RRE: $16.02

COMM: $17.77

PP: $42.80

MV: $37.62

(Per $1k of assessed value)

RRE: $16.02

COMM: $17.77

PP: $42.80

MV: $37.62

People:

2013 Population Est: 12,178

10-Year Pop. Growth: 12.7%

Unemployment Rate: 5.7%

Finance:

(Pension+Debt)/Receipts: 181%

Debt/Capita: $5,487.01

Pension Liability: $19,542,000

2013 Population Est: 12,178

10-Year Pop. Growth: 12.7%

Unemployment Rate: 5.7%

Finance:

(Pension+Debt)/Receipts: 181%

Debt/Capita: $5,487.01

Pension Liability: $19,542,000

Adjusted Funding Ratio: 51.50%

North Smithfield

51.50%

Mayor or Equivalent:

Donald R. Grebien

137 Roosevelt Avenue Pawtucket, RI 02860

Phone: 401-728-0500

Email:City Contact Page

Donald R. Grebien

137 Roosevelt Avenue Pawtucket, RI 02860

Phone: 401-728-0500

Email:City Contact Page

Tax Rates:

(Per $1k of assessed value)

RRE: $23.06

COMM: $30.88

PP: $52.09

MV: $53.30

(Per $1k of assessed value)

RRE: $23.06

COMM: $30.88

PP: $52.09

MV: $53.30

People:

2013 Population Est: 71,172

10-Year Pop. Growth: -2.5%

Unemployment Rate: 7.9%

Finance:

(Pension+Debt)/Receipts: 276%

Debt/Capita: $7,767.86

Pension Liability: $399,467,000

2013 Population Est: 71,172

10-Year Pop. Growth: -2.5%

Unemployment Rate: 7.9%

Finance:

(Pension+Debt)/Receipts: 276%

Debt/Capita: $7,767.86

Pension Liability: $399,467,000

Adjusted Funding Ratio: 26.50%

Pawtucket

26.50%

Mayor or Equivalent:

John C. Klimm

2200 East Main Road Portsmouth, RI 02871

Phone: 401-683-3255

Email:jklimm@portsmouthri.com

John C. Klimm

2200 East Main Road Portsmouth, RI 02871

Phone: 401-683-3255

Email:jklimm@portsmouthri.com

Tax Rates:

(Per $1k of assessed value)

RRE: $15.80

COMM: $15.80

PP: $15.80

MV: $22.50

(Per $1k of assessed value)

RRE: $15.80

COMM: $15.80

PP: $15.80

MV: $22.50

People:

2013 Population Est: 17,383

10-Year Pop. Growth: 1.4%

Unemployment Rate: 6.1%

Finance:

(Pension+Debt)/Receipts: 181%

Debt/Capita: $6,003.85

Pension Liability: $61,662,000

2013 Population Est: 17,383

10-Year Pop. Growth: 1.4%

Unemployment Rate: 6.1%

Finance:

(Pension+Debt)/Receipts: 181%

Debt/Capita: $6,003.85

Pension Liability: $61,662,000

Adjusted Funding Ratio: 34.70%

Portsmouth

34.70%

Mayor or Equivalent:

Jorge O. Elorza

25 Dorrance Street Providence, RI 02903

Phone: 401-421-2489

Email:Contact Us Page

Jorge O. Elorza

25 Dorrance Street Providence, RI 02903

Phone: 401-421-2489

Email:Contact Us Page

Tax Rates:

(Per $1k of assessed value)

RRE: $19.25

COMM: $36.75

PP: $55.80

MV: $60.00

(Per $1k of assessed value)

RRE: $19.25

COMM: $36.75

PP: $55.80

MV: $60.00

People:

2013 Population Est: 177,994

10-Year Pop. Growth: 2.5%

Unemployment Rate: 8.5%

Finance:

(Pension+Debt)/Receipts: 338%

Debt/Capita: $13,485.54

Pension Liability: $1,767,172,000

2013 Population Est: 177,994

10-Year Pop. Growth: 2.5%

Unemployment Rate: 8.5%

Finance:

(Pension+Debt)/Receipts: 338%

Debt/Capita: $13,485.54

Pension Liability: $1,767,172,000

Adjusted Funding Ratio: 19.50%

Providence

19.50%

Mayor or Equivalent:

Rob Rock

5 Richmond Townhouse

Richmond, RI 02898

Phone: 401-539-9000 Ext. 1

Email:

townadministrator@richmondri.com

Rob Rock

5 Richmond Townhouse

Richmond, RI 02898

Phone: 401-539-9000 Ext. 1

Email:

townadministrator@richmondri.com

Tax Rates:

(Per $1k of assessed value)

RRE: $20.94

COMM: $20.94

PP: $20.94

MV: $22.64

(Per $1k of assessed value)

RRE: $20.94

COMM: $20.94

PP: $20.94

MV: $22.64

People:

2013 Population Est: 7,613

10-Year Pop. Growth: 6.7%

Unemployment Rate: 4.2%

Finance:

(Pension+Debt)/Receipts: 23%

Debt/Capita: $648.54

Pension Liability: $3,172,000

2013 Population Est: 7,613

10-Year Pop. Growth: 6.7%

Unemployment Rate: 4.2%

Finance:

(Pension+Debt)/Receipts: 23%

Debt/Capita: $648.54

Pension Liability: $3,172,000

Adjusted Funding Ratio: 42.40%

Richmond

42.40%

Mayor or Equivalent:

Charles Collins, Jr.

195 Danielson Pike

Scituate, RI 02857

Phone: 401-640-7293

Email:CAC602@cox.net

Charles Collins, Jr.

195 Danielson Pike

Scituate, RI 02857

Phone: 401-640-7293

Email:CAC602@cox.net

Tax Rates:

(Per $1k of assessed value)

RRE: $18.8

COMM: $21.94

PP: $40.38

MV: $30.20

(Per $1k of assessed value)

RRE: $18.8

COMM: $21.94

PP: $40.38

MV: $30.20

People:

2013 Population Est: 10,433

10-Year Pop. Growth: 0.0%

Unemployment Rate: 5.5%

Finance:

(Pension+Debt)/Receipts: 136%

Debt/Capita: $4,301.00

Pension Liability: $29,187,000

2013 Population Est: 10,433

10-Year Pop. Growth: 0.0%

Unemployment Rate: 5.5%

Finance:

(Pension+Debt)/Receipts: 136%

Debt/Capita: $4,301.00

Pension Liability: $29,187,000

Adjusted Funding Ratio: 28.80%

Scituate

28.80%

Mayor or Equivalent:

Dennis Finlay

64 Farnum Pike

Smithfield, RI 02917

Phone: 401-233-1000

Email:dfinlay@smithfieldri.com

Dennis Finlay

64 Farnum Pike

Smithfield, RI 02917

Phone: 401-233-1000

Email:dfinlay@smithfieldri.com

Tax Rates:

(Per $1k of assessed value)

RRE: $17.13

COMM: $17.13

PP: $59.70

MV: $39.00

(Per $1k of assessed value)

RRE: $17.13

COMM: $17.13

PP: $59.70

MV: $39.00

People:

2013 Population Est: 21,410

10-Year Pop. Growth: 4.0%

Unemployment Rate: 6.1%

Finance:

(Pension+Debt)/Receipts: 155%

Debt/Capita: $4,573.50

Pension Liability: $89,988,000

2013 Population Est: 21,410

10-Year Pop. Growth: 4.0%

Unemployment Rate: 6.1%

Finance:

(Pension+Debt)/Receipts: 155%

Debt/Capita: $4,573.50

Pension Liability: $89,988,000

Adjusted Funding Ratio: 33.70%

Smithfield

33.70%

Mayor or Equivalent:

Stephen A. Alfred

180 High Street South Kingstown, RI 02879

Phone: 401-789-9331 Ext.1201

Email:

salfred@southkingstownri.com

Stephen A. Alfred

180 High Street South Kingstown, RI 02879

Phone: 401-789-9331 Ext.1201

Email:

salfred@southkingstownri.com

Tax Rates:

(Per $1k of assessed value)

RRE: $15.48

COMM: $15.48

PP: $15.48

MV: $18.71

(Per $1k of assessed value)

RRE: $15.48

COMM: $15.48

PP: $15.48

MV: $18.71

People:

2013 Population Est: 30,615

10-Year Pop. Growth: 9.7%

Unemployment Rate: 5.8%

Finance:

(Pension+Debt)/Receipts: 126%

Debt/Capita: $3,727.01

Pension Liability: $84,110,000

2013 Population Est: 30,615

10-Year Pop. Growth: 9.7%

Unemployment Rate: 5.8%

Finance:

(Pension+Debt)/Receipts: 126%

Debt/Capita: $3,727.01

Pension Liability: $84,110,000

Adjusted Funding Ratio: 44.20%

South Kingstown

44.20%

Mayor or Equivalent:

Denise M. deMedeiros

343 Highland Road

Tiverton, RI 02878

Phone: 401-625-6700

Email:

DdeMedeiros@tiverton.ri.gov

Denise M. deMedeiros

343 Highland Road

Tiverton, RI 02878

Phone: 401-625-6700

Email:

DdeMedeiros@tiverton.ri.gov

Tax Rates:

(Per $1k of assessed value)

RRE: $19.30

COMM: $19.30

PP: $19.30

MV: $19.14

(Per $1k of assessed value)

RRE: $19.30

COMM: $19.30

PP: $19.30

MV: $19.14

People:

2013 Population Est: 15,858

10-Year Pop. Growth: 3.4%

Unemployment Rate: 6.1%

Finance:

(Pension+Debt)/Receipts: 172%

Debt/Capita: $5,117.87

Pension Liability: $40,176,000

2013 Population Est: 15,858

10-Year Pop. Growth: 3.4%

Unemployment Rate: 6.1%

Finance:

(Pension+Debt)/Receipts: 172%

Debt/Capita: $5,117.87

Pension Liability: $40,176,000

Adjusted Funding Ratio: 41.70%

Tiverton

41.70%

Mayor or Equivalent:

Thomas Gordon

Main Street

Warren, RI 02885

Phone: 401-245-7554

Email:tgordon@townofwarren-ri.gov

Thomas Gordon

Main Street

Warren, RI 02885

Phone: 401-245-7554

Email:tgordon@townofwarren-ri.gov

Tax Rates:

(Per $1k of assessed value)

RRE: $20.07

COMM: $20.07

PP: $20.07

MV: $26.00

(Per $1k of assessed value)

RRE: $20.07

COMM: $20.07

PP: $20.07

MV: $26.00

People:

2013 Population Est: 10,542

10-Year Pop. Growth: -6.6%

Unemployment Rate: 6.9%

Finance:

(Pension+Debt)/Receipts: 154%

Debt/Capita: $3,444.63

Pension Liability: $24,728,000

2013 Population Est: 10,542

10-Year Pop. Growth: -6.6%

Unemployment Rate: 6.9%

Finance:

(Pension+Debt)/Receipts: 154%

Debt/Capita: $3,444.63

Pension Liability: $24,728,000

Adjusted Funding Ratio: 32.90%

Warren

32.90%

Mayor or Equivalent:

Scott Avedisian

3275 Post Road

Warwick, RI 02886

Phone: 401-738-2000 Ext.6200

Email:

mayorsoffice@warwickri.com

Scott Avedisian

3275 Post Road

Warwick, RI 02886

Phone: 401-738-2000 Ext.6200

Email:

mayorsoffice@warwickri.com

Tax Rates:

(Per $1k of assessed value)

RRE: $20.06

COMM: $30.09

PP: $40.12

MV: $34.60

(Per $1k of assessed value)

RRE: $20.06

COMM: $30.09

PP: $40.12

MV: $34.60

People:

2013 Population Est: 81,971

10-Year Pop. Growth: -3.7%

Unemployment Rate: 5.9%

Finance:

(Pension+Debt)/Receipts: 284%

Debt/Capita: $10,177.36

Pension Liability: $647,428,000

2013 Population Est: 81,971

10-Year Pop. Growth: -3.7%

Unemployment Rate: 5.9%

Finance:

(Pension+Debt)/Receipts: 284%

Debt/Capita: $10,177.36

Pension Liability: $647,428,000

Adjusted Funding Ratio: 32.60%

Warwick

32.60%

Mayor or Equivalent:

Kevin A. Breene

280 Victory Highway West Greenwich, RI 02817

Phone: 401-392-3800 Ext. 123

Email:kabreene@wgtownri.org

Kevin A. Breene

280 Victory Highway West Greenwich, RI 02817

Phone: 401-392-3800 Ext. 123

Email:kabreene@wgtownri.org

Tax Rates:

(Per $1k of assessed value)

RRE: $22.55

COMM: $22.55

PP: $33.85

MV: $19.02

(Per $1k of assessed value)

RRE: $22.55

COMM: $22.55

PP: $33.85

MV: $19.02

People:

2013 Population Est: 6,105

10-Year Pop. Growth: 20.6%

Unemployment Rate: 4.7%

Finance:

(Pension+Debt)/Receipts: 87%

Debt/Capita: $2,659.98

Pension Liability: $8,879,000

2013 Population Est: 6,105

10-Year Pop. Growth: 20.6%

Unemployment Rate: 4.7%

Finance:

(Pension+Debt)/Receipts: 87%

Debt/Capita: $2,659.98

Pension Liability: $8,879,000

Adjusted Funding Ratio: 35.60%

West Greenwich

35.60%

Mayor or Equivalent:

Frederick J. Presley

1170 Main Street West Warwick, RI 02893

Phone: 401-822-9200

Email:

Fpresley@westwarwickri.org

Frederick J. Presley

1170 Main Street West Warwick, RI 02893

Phone: 401-822-9200

Email:

Fpresley@westwarwickri.org

Tax Rates:

(Per $1k of assessed value)

RRE: $25.39

COMM: See Notes*

PP: $40.13

MV: $28.47

(Per $1k of assessed value)

RRE: $25.39

COMM: See Notes*

PP: $40.13

MV: $28.47

People:

2013 Population Est: 29,893

10-Year Pop. Growth: -1.3%

Unemployment Rate: 6.9%

Finance:

(Pension+Debt)/Receipts: 249%

Debt/Capita: $7,766.16

Pension Liability: $173,471,000

2013 Population Est: 29,893

10-Year Pop. Growth: -1.3%

Unemployment Rate: 6.9%

Finance:

(Pension+Debt)/Receipts: 249%

Debt/Capita: $7,766.16

Pension Liability: $173,471,000

Adjusted Funding Ratio: 17.00%

West Warwick

17.00%

Mayor or Equivalent:

Michelle A. Buck

Broad Street

Westerly, RI 02891

Phone: 401-348-2530

Email:mbuck@westerly.org

Michelle A. Buck

Broad Street

Westerly, RI 02891

Phone: 401-348-2530

Email:mbuck@westerly.org

Tax Rates:

(Per $1k of assessed value)

RRE: $10.64

COMM: $10.64

PP: $10.64

MV: $29.67

(Per $1k of assessed value)

RRE: $10.64

COMM: $10.64

PP: $10.64

MV: $29.67

People:

2013 Population Est: 22,657

10-Year Pop. Growth: -0.8%

Unemployment Rate: 5.1%

Finance:

(Pension+Debt)/Receipts: 136%

Debt/Capita: $4,865.23

Pension Liability: $34,577,000

2013 Population Est: 22,657

10-Year Pop. Growth: -0.8%

Unemployment Rate: 5.1%

Finance:

(Pension+Debt)/Receipts: 136%

Debt/Capita: $4,865.23

Pension Liability: $34,577,000

Adjusted Funding Ratio: 31.20%

Westerly

31.20%

Mayor or Equivalent:

Leo Fontaine

169 Main Street

Woonsocket, RI 02895

Phone: 401-762-6400

Email:

leofontaine@woonsocketri.org

Leo Fontaine

169 Main Street

Woonsocket, RI 02895

Phone: 401-762-6400

Email:

leofontaine@woonsocketri.org

Tax Rates:

(Per $1k of assessed value)

RRE: $35.94

COMM: $39.99

PP: $46.58

MV: $46.58

(Per $1k of assessed value)

RRE: $35.94

COMM: $39.99

PP: $46.58

MV: $46.58

People:

2013 Population Est: 41,026

10-Year Pop. Growth: -4.7%

Unemployment Rate: 8.1%

Finance:

(Pension+Debt)/Receipts: 364%

Debt/Capita: $11,234.89

Pension Liability: $240,955,000

2013 Population Est: 41,026

10-Year Pop. Growth: -4.7%

Unemployment Rate: 8.1%

Finance:

(Pension+Debt)/Receipts: 364%

Debt/Capita: $11,234.89

Pension Liability: $240,955,000

Adjusted Funding Ratio: 43.90%

Woonsocket

43.90%

As of 2-25-2014